Deciding to buy a home in the Netherlands is a big step — but now you also need to decide which type of Dutch mortgage suits you best.

That can’t be too hard, right? Of course, an annuity mortgage is the right option for you! But then a linear mortgage also has benefits — and an interest-only mortgage could save you some money, right?

Feeling lost? Geen probleem! We’ve gathered the most common Dutch mortgage types for you to consider. Let’s break them down. 👇

The two main mortgage options in the Netherlands

Let’s start with the basics — and by that, we mean the types of mortgages most people choose. In the Netherlands, there are two main types of mortgages that most home buyers will opt for: the annuity mortgage and the linear mortgage.

Not sure where to start? Set up a free consultation with ING’s experts to calculate your maximum mortgage and learn a bit more about your mortgage options in the Netherlands.

The annuity mortgage (Annuïteitenhypotheek)

If you’re the type of person who enjoys the comfort of routine and repetition, then an annuity mortgage may be the choice for you.

Why? With an annuity mortgage, you pay the exact same amount each month (unless you opt for a variable interest rate or the mortgage terms change).

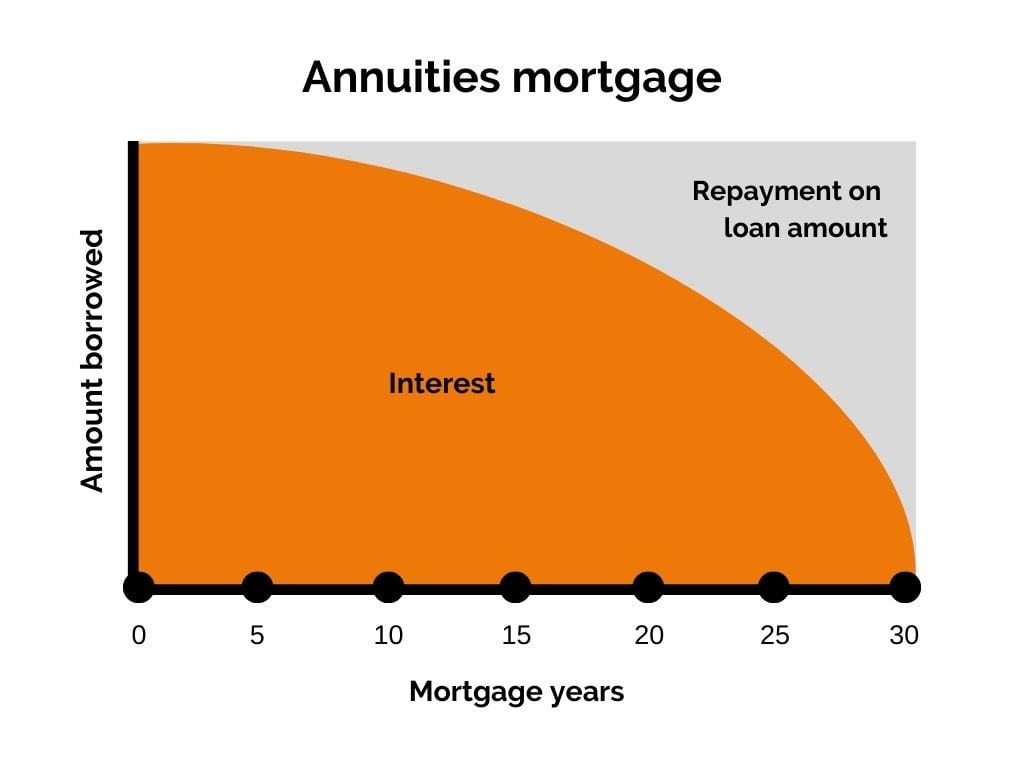

This amount will be made up of your interest plus your mortgage repayment.

However, while the amount you pay will always remain the same, the ratio between interest and mortgage repayment will vary.

For example: if you have an annuity mortgage of €1,200 every month, you will always pay exactly €1,200. However, one month, this €1,200 may cover 60% mortgage repayment and 40% interest. The next month, it may be 62% mortgage repayment and 38% interest.

At the beginning of your mortgage term, most of your monthly payment will likely be the interest.

By the end, most of the payment will go off the amount that you borrowed.

Regardless of the ratio, you can rest easy knowing that you will be paying the exact same amount each month (unless you have opted for a mortgage term with variable interest rates).

✅ Pros: It’s simple. There are no unpleasant surprises at the end of the month, you know how much is due.

❌ Cons: You ultimately pay more interest throughout the term of the mortgage than you would with a linear mortgage.

The linear mortgage (Lineaire hypotheek)

With a linear mortgage, you hit the ground running. This is because your monthly payments will be at their highest at the beginning of the mortgage term — however, they will gradually decrease.

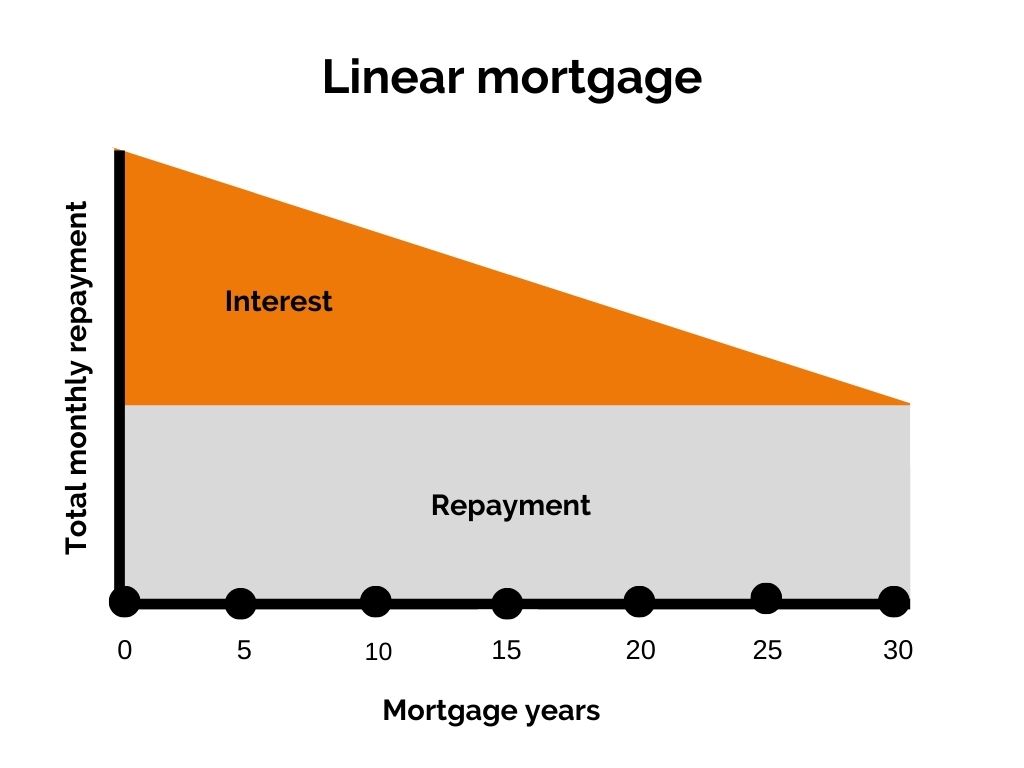

In a linear mortgage, you pay the same amount of mortgage repayment each month. This means that, unlike an annuity mortgage, the monthly mortgage repayment is fixed.

However, the amount of interest that you pay each month will decrease as the mortgage term progresses.

This means you pay less and less throughout the mortgage term.

For example, at the beginning of the mortgage term, you might have a monthly mortgage repayment of €1,200 and an interest payment of €400 — meaning you pay roughly €1,600 towards your mortgage per month.

However, two years later, your monthly mortgage repayment will still be €1,200 but your interest will have dropped to €350 — meaning you now pay €1,550 per month.

As more and more of your interest is paid off, the total amount you pay every month will gradually lower — handig!

✅ Pros: The mortgage is paid off faster with a linear mortgage, meaning you are less likely to be left with residual debt should you decide to sell your home. Paying more at the start is also a good option if you see other financial burdens (like children) coming your way in the future.

❌ Cons: You benefit less from interest deductions as the mortgage term progresses, and you pay more than you would with other mortgages at the start.

Other mortgage options in the Netherlands

While annuity and linear mortgages are certainly the most popular in the Netherlands, they aren’t the only mortgage types out there.

There are, in fact, several quirky mortgage models in the Netherlands.

Need an expert’s opinion on which mortgage option is best for you? ING has helped countless internationals secure a mortgage in the Netherlands. Schedule a free appointment.

Interest-only mortgage (aflossingsvrije hypotheek)

An interest-only mortgage is exactly what it says on the tin. You pay only the interest on your mortgage throughout the mortgage term (which is usually a maximum of 30 years.)

Then, once you reach the end of the term, you hand over the entirety of the mortgage repayment.

If you are unable to do this, you can opt to extend the mortgage or sell your house.

An interest-only mortgage isn’t for everyone and lenders will usually take a good look at your file before you are granted one.

Interest-only mortgages are often a good idea if you are looking for more financial freedom at the beginning of your mortgage.

With interest rates relatively low at the moment (compared to 15 years ago, for example), your monthly payments would also be low.

Note: The below mortgage types still exist in the Netherlands, however, they are no longer offered to starters. Homeowners with these types of mortgages are advised to switch to either a linear, annuities, or interest-only mortgage.

For those who already have one of these mortgage options, this is what they look like:

Bank savings mortgage (bankspaarhypotheek)

Similar to an interest-only mortgage, a bank savings mortgage allows you to set aside money for your mortgage repayments in a locked bank account.

The account can only be used to hold money for your mortgage. Once you reach the end of your mortgage term, the mortgage repayments will be withdrawn from the account in one big, beautiful lump sum and used to pay off the mortgage.

Throughout the term of your mortgage, you only pay your mortgage interest.

Aside from the obvious advantage of lower monthly repayments, another plus of having a bank savings mortgage is that your savings can grow tax-free.

Life mortgage (Levenhypotheek)

With a life mortgage, you take out a life insurance policy and use this to pay off your mortgage at the end of the mortgage term.

It works like this: you pay no mortgage repayments throughout the mortgage term and instead make monthly payments towards your mortgage interest and your life insurance premium.

While you aren’t making mortgage repayments during the term, you are investing money in your life insurance policy — which consists of both a saving or investments portion and a death risk portion. This way, part of the mortgage can be repaid in case of death.

At the end of the term, the built-up capital is used to pay the mortgage repayments.

Luckily, you don’t need to die for that to happen — the investment is returned to the bank, and the capital gained is (hopefully) enough to cover your mortgage.

We’ve got to admit it, the Dutch are certainly inventive.

A hybrid mortgage (hybride hypotheek)

You can think of a hybrid mortgage as a mix of a bank savings mortgage and a life mortgage. Throughout the term of the mortgage, you only pay the interest plus a savings/investment premium.

This means that you can decide to either pay your premium into savings or investments — or you can spice it up and do both!

Regardless of your choice, once you reach the end of the mortgage term, you will pay off the mortgage repayment (hopefully) using the accrued savings.

Tax-deductible Dutch mortgage types

One huge pro of opting for either an annuity or linear mortgage is that the interest on both of these mortgage types is tax deductible in the Netherlands.

This means that, as long as you meet certain conditions, you can receive back a percentage of the mortgage interest you paid when filing your income tax return.

In 2024, this amount is 36.97% of the mortgage interest paid on annuity or linear mortgages.

Which mortgage should I consider as an international in the Netherlands?

As an international in the Netherlands, it’s good to know that you will be offered the same options as a Dutch person who applies for a mortgage, namely: an annuities mortgage, a linear mortgage, or an interest-only mortgage.

That being said, everyone’s situation is different. As an international, it may be best to opt for either an annuities mortgage or a linear mortgage. Here’s why:

- Both mortgage options work for almost everyone’s circumstances, which means there’s a good chance they will work for yours too.

- The simplicity of annuity and linear mortgages means that you are less likely to come across any unpleasant hiccups during the mortgage process — and no one needs that when it’s all happening in a different language.

- The interest on annuities and linear mortgages is tax-deductible. This is not the case with other mortgage types.

Deciding on a mortgage in a different country can be scary at first, but remember to trust your instincts — they brought you here, didn’t they? 😉

How did you find the experience of choosing a mortgage in the Netherlands? Tell us in the comments below!

Types of mortgages in the Netherlands: Frequently asked questions

Which Dutch mortgages are tax deductible?

In the Netherlands, mortgage interest on linear mortgages (Lineaire hypotheek) and annuities mortgages (Annuïteitenhypotheek) is tax deductible.

All other Dutch mortgage types do not offer tax-deductible mortgage interest.

Can a non-national get a mortgage in the Netherlands?

Your nationality has no effect on which Dutch mortgage types you can apply for.

However, if you are a starter, you are only eligible for a linear mortgage (lineaire hypotheek), annuities mortgage (annuïteitenhypotheek), or an interest-only mortgage (aflossingsvrije hypotheek).

What is the mortgage term in the Netherlands?

A mortgage in the Netherlands is typically up to 30 years maximum. However, most banks will allow borrowers to choose a shorter term if they wish.

What are the different Dutch mortgage types?

In the Netherlands, there are several different mortgage types. These include:

- Annuities mortgage (Annuïteitenhypotheek),

- Linear mortgage (Lineaire hypotheek),

- Interest-only mortgage (aflossingsvrije hypotheek),

- Bank savings mortgage (bankspaarhypotheek),

- Life mortgage (Levenhypotheek),

- A hybrid mortgage (hybride hypotheek).