Want to read your Dutch payslip like a pro?

You’ve scored the job, filled out the paperwork, put in the working hours, and your hard-earned euros have landed in your Dutch bank account. Now it’s time to check your payslip for all those other nice benefits like vacation time, your pension, and perhaps your secondary benefits.

But wait! Sorry to roet in het eten gooien (throw soot in the food), but there’s a hurdle you’ll have to overcome first: Dutch payslips can be a pain in the butt to read.

Why? Your Dutch pay stub is full of confusing phrases, numbers, and long Nederlandse words that throw fear in the heart of even natives. But never fear: here’s what to know about your Dutch payslip — and how to read it like a pro.

We turn to the experts when it comes to all things about employment and recruitment in the Netherlands: Undutchables! We teamed up to write the ultimate explainer on those tricky Dutch payslips.

When and how do I receive a Dutch payslip?

If you’re employed in the Netherlands, your employer must give you a payslip (loonstrook) with your first salary or whenever something changes in wages or payroll taxes. Most employers typically give you a payslip at the end of each month.

Your pay stub may be delivered via email, through an internal system, or perhaps even on paper — although that’s less common in the age of technology. 👩🏼💻

Why should I read my Dutch payslip?

Money makes the world go round, pays for your brood, and lets you take nice vacations (hopefully). That’s why it’s important to check your Dutch payslip so you know:

- Your gross and net salary (before and after tax)

- Allowances and reimbursements that you’re entitled to

- How much holiday pay you have accrued

- How much leave you are entitled to

Your payslips are also an important part of Dutch life: you’ll need to provide them if you rent or buy a house, apply for any kind of financing, or sometimes even if you sign a phone contract. These, and your employment contract, are proof that you earn your moolah.

Dutch payslip terminology breakdown

The time has come! Got your Dutch payslip in front of you? We’ll break this down into three easy sections: the top, middle, and bottom of your payslip.

A quick note first: we’ve dug and dug to find the most terms, but it’s possible your payslip uses a different structure or terminology. In that case, head on over to your HR department and they’ll be able to clear it all up for you!

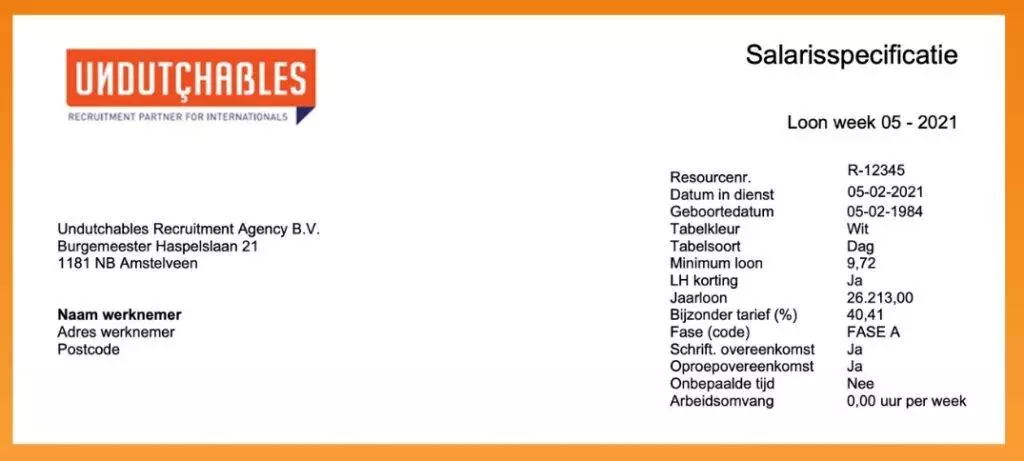

Top of a Dutch payslip: personal, date, and employment details

All of your basic information belongs at the very top of your payslip — this typically doesn’t change month-to-month. Your and your company’s names and addresses will sit somewhere near the top.

Move your gaze and you’ll find more personal and factual information. Here’s a quick rundown:

Datum in dienst (Start date)

The start date of your contract with the company.

Geboortedatum (Date of birth)

Your date of birth (as shown on your ID)

Tabelkleur (Tax table colour)

This is determined by the tax office. White is for current employment, green is for past employment (for example, if you’re receiving a pension or unemployment benefit).

Minimum loon (Minimum wage)

The legal minimum wage which must be paid to the employee as determined by the government.

Personeelsnummer/Resourcenummer (Employee number)

The employee identification number your company or recruiter has assigned to you.

Jaarloon (Annual salary)

Your annual salary for the previous year. If you’ve just begun your job, this will be your starting salary calculated as an annual figure.

Bijzonder tarief % (Special tax percentage)

The tax rate on special wages like holiday pay, overtime, or bonuses.

Dagen tijdvak (Time period)

The period of time that the payslip represents.

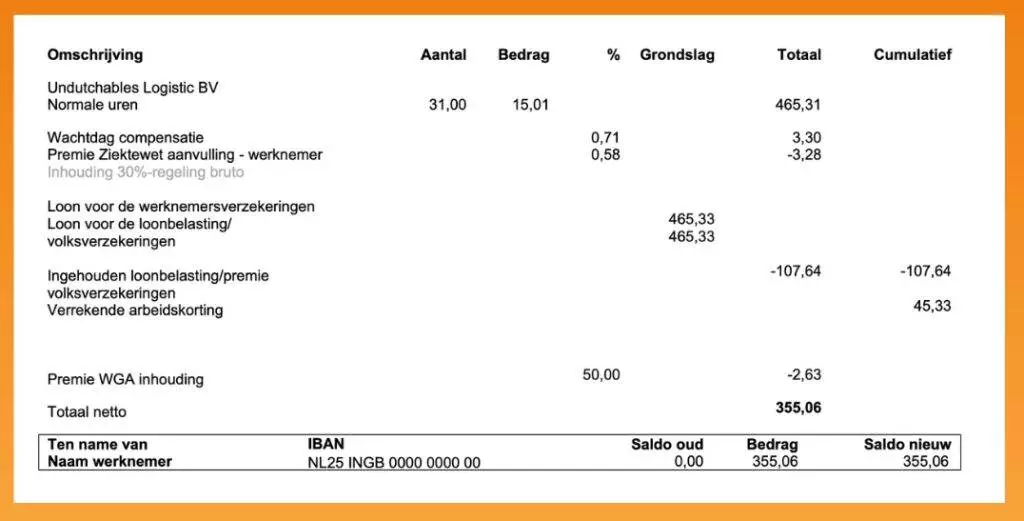

Middle of a Dutch payslip: salary calculations

The middle of your Dutch payslip holds information more specific to the current period and how your payment has been divided.

Dagen gewerkt (Days worked)

The number of days the employee worked in the time period above.

Verloonde uren (Paid hours)

The number of hours the employee is paid for the time period.

Normale uren (Normal hours)

The total number of hours worked and your gross hourly rate.

Overuren (Overtime)

The number of overtime hours worked and the hourly overtime rate if applicable.

Bruto (Gross wage)

Now we’re into the good stuff. Bruto is your gross salary from the payslip’s period added to your pension amount or other tax extras, like a company car allowance.

Werknemer verzekering (Wages for employees insurance)

This is the premium employers pay in case their employees suffer loss of income if they become unemployed, incapacitated for work or ill. These insurances are:

- Unemployment Insurance Act (WW)

- Disability Insurance Act (WAO)

- Work and Income according to Capacity for Work Act (WIA)

- Sickness Benefits Act (ZW)

Your employer may pass a portion of the insurance costs on to you, which will be reflected on your payslip (likely under WHK premie).

Verblijfskosten/vergoedingen/inhoudingen (Tax free allowances/deductions)

Any tax free reimbursements or deductions if applicable, such as the 30% tax ruling that some internationals are eligible for.

LH Korting/Loonheffingskorting (Payroll tax credit)

This is a general tax discount for employed people that must be applied for before it can be granted. You may be eligible for multiple discounts.

Loonheffing/Ingehouden loonbelasting/Premie volksverzekeringen (Payroll tax rate)

The amount of payroll tax and social security deducted from your gross salary.

Netto loon tijdvak (Net wages)

Net salary after tax deductions, but before additional reimbursements and deductions.

Declaratie onkosten (Declared expenses)

Any costs you have claimed back from your employer, such as fuel, kilometres driven to visit clients, dinners while away, or the cost of using your phone for work purposes.

Reiskosten (Travel costs)

Your net travel expenses, such as taking the train to work (if your employer covers this cost).

Totaal Netto/Totalen (Total)

The total salary paid to you for the period (net).

Betalen (Paid)

The bank account details where your salary was or will be deposited.

- IBAN (Account number)

- Saldo oud (Old balance: any outstanding amount your employer already owed)

- Bedrag (Amount)

- Saldo nieuw (To be paid)

Cumulatief (Cumulative)

Your accumulated salary over the months of the year so far.

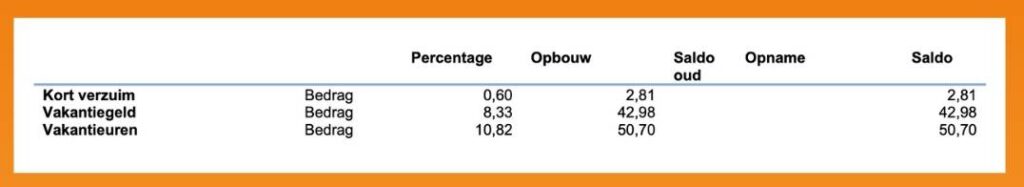

Bottom of a Dutch payslip: long-term calculations

At the bottom of your Dutch payslip, you’ll typically find all your long-term calculations. These can be:

Reservering (Balances reserved for later)

This section will cover different types of leave and allowances. You’ll likely see calculations for:

- Opbouw (the amount earned in the payslip period)

- Opname (any amounts you used in the payslip period)

- Saldo (the balance of the hours you have left)

Kort verzuim in geld (Short term leave)

Total hours built for short-term leave, such as going to the dentist or the doctor.

Vakantiebijslag (Holiday allowance)

Paid to take a holiday? In the Netherlands, hell yeah! This section will show how much you have built towards your holiday pay which is paid out in May.

Vakantieuren wettelijk (Statutory holiday hours)

The total amount of hours built up for your holiday allowance. The minimum number you are entitled to each year is four times the number of working days per week. If you work full-time your minimum will be 20 days per year.

Vakantieuren bovenwettelijk (Non-statutory holiday hours)

Hours built up toward non-statutory holiday days. These days are normally defined in your employee handbook or collective labour agreement. It differs per industry, so check with your HR department to find which ones apply to you.

SV/ZVW/WW/WAO Loon (Insurances salary)

The wages on which you must pay taxes and social security contributions.

Pensioengevend loon (Pension fund salary)

Your salary for pension purposes.

You did it! After receiving a payslip from your Dutch employer that looks like it was written by an over-enthusiastic three-year-old, you’ve cracked the code and deciphered the goods. Now the only thing that’s left to do is spend your hard-earned cash!

Not happy with your payslip — or your employer? Head on over to Undutchables and check out their current vacancies!

Want to know more about working in the Netherlands? Learn more about understanding your Dutch employment contract, speaking Dutch at work, and extra benefits you could be claiming from your Dutch company!

What confused you the most when you received your Dutch payslip? Tell us in the comments below!

Feature Image: IgorVetushko/Depositphotos

The 30% ruling can be confusing on the payslip as well.

Totally agree! I just got my first payslip after the 30% tax ruling was approved and I am beyond confused

My son has a retention of 1000€ under the

“In houdigen” header.

But he has no idea why? Last wage slip for the company. Would this be relevant?

Should they not give an explanation why?

the travel costs.