So you finally decided to buy a house in the Netherlands instead of renting. Congrats! That’s a big move — especially this year. Now it’s time to set yourself up with a Dutch mortgage.

While there are certainly simpler things in life, getting a mortgage in the Netherlands doesn’t have to be a daunting endeavour.

Here are our answers to seven burning questions every international might be asking before securing a Dutch mortgage in 2024.

- 👩👩👦👦 1. Who can get a mortgage in the Netherlands?

- 💰 2. How much can I borrow for a mortgage in the Netherlands?

- 💶 3. What are the upfront costs of a Dutch mortgage?

- 📈 4. What are the Dutch mortgage interest rates?

- 🤔 5. What type of Dutch mortgages are there?

- 🏠 6. What is the National Mortgage Guarantee a.k.a ‘Nationale hypotheek garantie’?

- 🙋 7. I want a Dutch mortgage! Where do I start?

1. Who can get a mortgage in the Netherlands?

If you’re planning to buy a house in the Netherlands in 2024, then it might be good to know whether it’s actually possible at all. And often, it is — regardless of your nationality.

In the past, banks were hesitant to give out mortgages to internationals.

However, we now see that more and more mortgage suppliers are adjusting their criteria for obtaining a Dutch mortgage to suit anyone who wants to buy a house, be they Dutch or international.

Are you an international who wants a Dutch mortgage? Expat Mortgages offers completely free consultations for people just like you. Reach out now to walk through your options. 💪

Curious about how much you could borrow? Try a free mortgage calculator!

Getting a mortgage in the Netherlands: criteria and factors

There are several factors that will affect your chances of obtaining a mortgage in the Netherlands.

- Where you live: The one condition that applies to every bank and everyone applying for a Dutch mortgage is that you must live in the Netherlands.

If you want to buy a house and need a mortgage, then this house must be located in the Netherlands, and you must be registered at a Dutch address.

READ MORE | Am I eligible to get a mortgage in the Netherlands?

Obviously, for a Dutch person, meeting this requirement is easy-peasy. For internationals, there are a few hurdles to jump:

- If you come from the EU or EEA, then you need to be registered at a Dutch address and have a BSN, but otherwise, there are no additional requirements.

- If you’re not from the EU, don’t fret, it’s still possible to get a mortgage in the Netherlands! The key is that you are registered here (i.e, you have a residence permit.) 🔑

- Employment history: This is a factor that is considered to a lesser extent. Mortgage lenders will mostly focus on whether you’re a regular employee or an entrepreneur, how long you have been working here, and whether you have a permanent contract or not.

While employment history is a factor to consider when applying for a mortgage, it usually won’t have too big an impact on your eligibility for a mortgage.

What it will have a potential effect on, however, is your potential borrowing power.

2. How much can I borrow for a mortgage in the Netherlands?

Ah! The million-dollar (or €450,000) question: How much money can you borrow for a mortgage in the Netherlands?

The most important factor that determines how much you can borrow is your income — no surprises there.

But there are also plenty of other things that will be taken into consideration when determining just how much you are eligible to borrow for a Dutch mortgage. What are they?

Your work contract

Are you a regular employee or an entrepreneur? How long have you been an entrepreneur? Do you have a permanent contract, a fixed contract, or a letter of intent from your employer?

READ MORE | 7 things you need as a freelancer in the Netherlands

The lower the risk, the more you will be able to borrow for your Dutch mortgage.

Are you buying with a partner?

The income of your partner will also be included in the mortgage plan and help determine your borrowing power.

READ MORE | 7 ways buying a house in the Netherlands could save you money (wait what?)

The second income isn’t taken into account for 100% of the value, however. Instead, 90% of the second income will be taken into account when calculating your borrowing power.

The house value

In 2024, you cannot finance more than 100% of the house value (or 106% if you plan on making sustainable renovations).

This means that any additional costs must be covered by you, the buyer (kosten koper).

Make sure to take this into account when you bid on a home (and especially if you decide to offer above the asking price!)

The mortgage interest rates

What are the current mortgage interest rates like? This will, of course, have an effect on how much you can borrow.

Mortgage interest rates also differ depending on which type of interest rate period you opt for — for example, do you want to go for a fixed-rate period? A variable period?

We’ll take a deep dive into current mortgage interest rates below!

How much can your Dutch mortgage be?

The Dutch Institute NIBUD determines the amount one can borrow with a specific income. All lenders use these figures, so these rules apply to everyone.

READ MORE | Your borrowing power for a Dutch mortgage in 2024

However, there are a number of personal factors that will also influence how high your Dutch mortgage can be. These include:

- Your work contract

- Whether you are a freelancer or an employee

- Whether or not you have a partner

- Any debts you may have

Do you have student debt? Don’t worry. Student debts are seen as less serious debts than others.

As of 2024, only your current student debt will be considered when calculating your borrowing power, as opposed to the initial debt. Your monthly repayments will be taken into account when determining how much you can borrow.

Making sustainable changes?

As of January 2024, home buyers in the Netherlands can borrow more money to purchase a home and improve its energy label.

These amounts are determined by where the house’s energy label falls:

- The lower the energy rating, the more money you can borrow to implement energy-saving measures in the home.

- The higher the energy rating, the more you can borrow to purchase the home.

Singles can borrow extra

If you are single and not looking to mingle, you don’t have to give up on your dream of owning a home. In fact, this year, your borrowing power just increased.

As of January 2024, single people in the Netherlands with an income of at least €28,000 will be eligible to borrow an extra €16,000 towards buying a home.

Want to calculate your potential mortgage? Expat Mortgage’s mortgage calculator is the perfect way to get that ballpark figure.

3. What are the upfront costs of a Dutch mortgage?

In the Netherlands, you can finance up to 100% of the market value of your house (or 106% if you make sustainable changes.) The market value is determined by the local municipalities, which perform a valuation each year.

So, if the value is €385,000, you can get a mortgage for as much as €385,000. Sounds pretty good, right?

However, keep in mind that you will still have to bring some of your own money to the table.

There are several costs involved in buying a property that can’t be financed by a Dutch mortgage (although a mortgage intermediary can sometimes help with this).

As a rule of thumb, the costs of buying a house in the Netherlands will be roughly 4% to 6% of the buying price.

These are some of the costs you should expect to pay out of pocket:

| Cost | Amount |

|---|---|

| Transfer tax | In 2024, this is 2% of the sale price of the house. ‘Starters’ up to the age of 35 are exempt from the transfer tax if the house price is less than €510,000. |

| Fee for the valuation report (taxatierapport) (required) | Anywhere between €500 and €1,000. |

| Arrangement fee for the mortgage | Depends on the mortgage provider |

| Fee for the notary | Approximately €2,500, including VAT and a translator |

| Structural survey (bouwkundig rapport) (optional) | Approximately €500 |

| Real estate agent (optional) | Between €4,000 and €5,000 |

What mortgage costs are tax deductible?

Another plus for the Netherlands is that many of the costs of obtaining a mortgage are also tax-deductible.

These costs include:

- Advisory and mediation costs

- Notary costs

- Costs for a construction deposit (bouwdepot)

- The valuation report,

- The costs of the mortgage deed,

- The possible costs for the NHG.

READ MORE | Which experts should you use when buying a house and can they save you money?

In my personal situation, we paid around €6,000, and €3,000 was returned to us after a few months through a voorlopige teruggaaf (provisional refund) — the first time I was ever happy with the taxman!

4. What are the Dutch mortgage interest rates?

This is something definitely worth considering before you get a mortgage in the Netherlands.

Over the past few years, the Netherlands has enjoyed historically low mortgage interest rates. This gave hopeful buyers a boost when taking out a mortgage.

However, in 2022, these interest rates increased for the first time in years.

As a result, in the past year few years, mortgage interest rates have jumped to as high as 5.45%, depending on the interest period and mortgage type you opt for.

Don’t be discouraged, however. In the grand scheme of things, these interest rates are still very manageable. ABN AMRO also predicts that these figures will drop slightly and stabilise in 2024.

While they may come as a shock to the Dutch after enjoying such low rates for a while, for many internationals, these interest rates are nothing new.

5. What type of Dutch mortgages are there?

There are quite a few types of mortgages in the Netherlands, but the two most common ones are the annuity mortgage (annuïteitenhypotheek) and the linear mortgage (lineare hypotheek).

Note: These two types of mortgages are the only mortgages that are eligible for the interest tax deduction, which is usually what you’re aiming for.

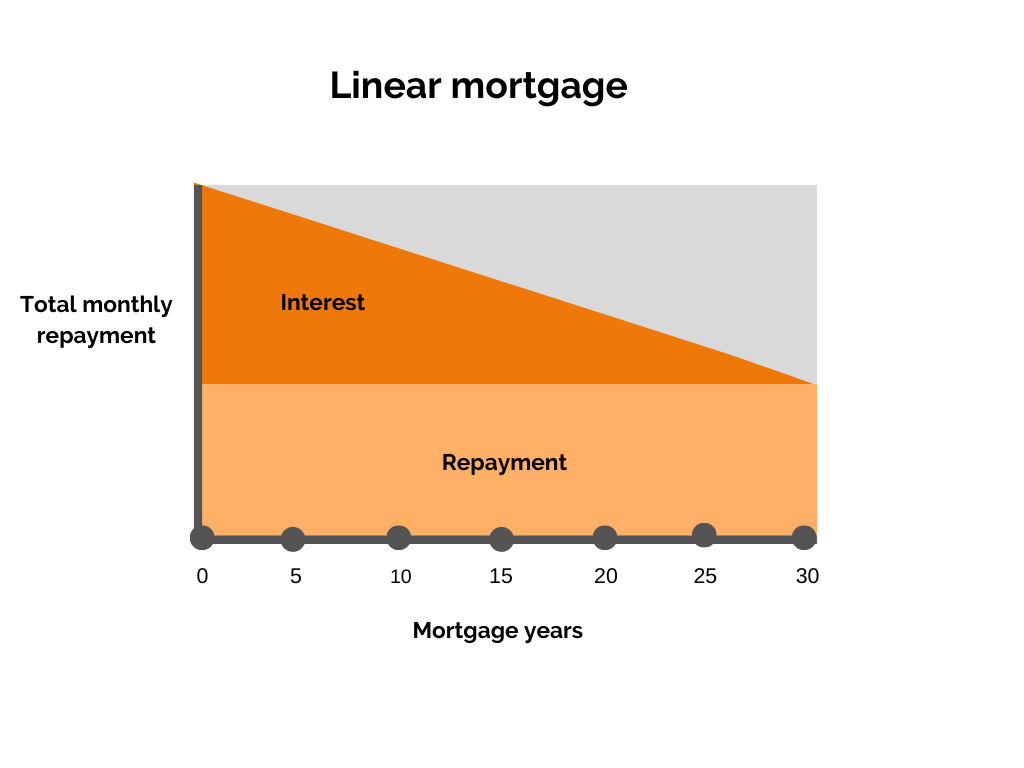

Linear mortgage (lineaire hypotheek)

With a linear mortgage (lineaire hypotheek), the amount of debt that you pay remains fixed every month.

On top of the debt, you will also pay interest, which will be the highest at the beginning of the mortgage since you haven’t paid anything back yet.

At the beginning of a linear mortgage, the costs are high, but they will gradually decrease.

This means paying off your mortgage in the Netherlands will probably go fastest if you opt for this kind of mortgage.

✅ Pros: The total amount paid overall is lower because you pay less interest as you start to pay off the actual sum immediately.

❌ Cons: You pay a higher amount at the beginning of the mortgage (and most of the time, this is the period in your life when you’re making less money because your salary typically increases with age).

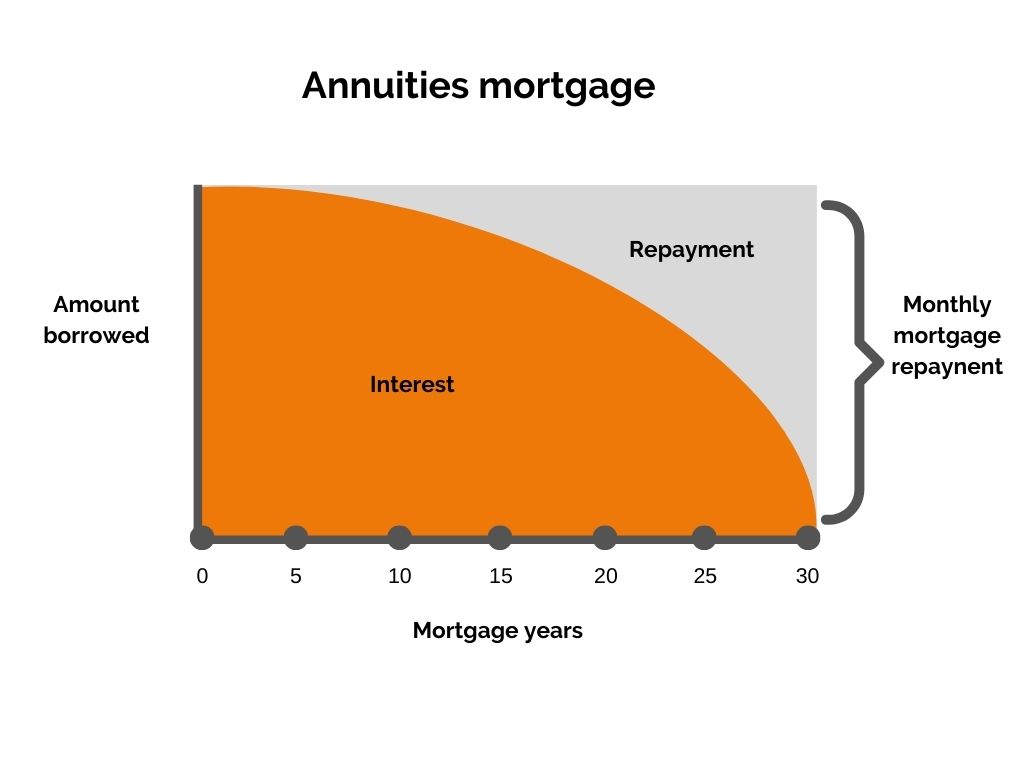

Annuity mortgage (annuiteiten hypotheek)

With an annuity mortgage (annuiteiten hypotheek), you will pay the same amount over the whole period of the mortgage.

In the beginning, this amount is mainly interest and only a small part of the loan. Gradually, this changes so that your loan will mainly be repaid at the end of the mortgage.

✅ Pros: You usually have lower monthly payments in the early years of the mortgage period than with a linear mortgage.

The high amount of interest can be deducted from taxes, which makes your net monthly cost low at the beginning of the mortgage.

❌ Cons: You will pay more interest, which means you’ll pay more for your whole mortgage compared to a linear mortgage.

6. What is the National Mortgage Guarantee a.k.a ‘Nationale hypotheek garantie’?

If you’ve been planning to buy a house for a while now, you’ve probably come across this complex term called National Mortgage Guarantee a few times. Here in the Netherlands, we like to call it the Nationale Hypotheek Garantie (NHG).

READ MORE | What is the Dutch National Mortgage Guarantee (NHG)?

The NHG is a protection against any debt that still stands if you can’t pay your mortgage due to involuntary unemployment, divorce, or the inability to work.

Should anything like this happen, the people at the NHG and your bank will try to find solutions so that you are able to stay in your house (instead of selling it).

Alternatively, if you do need to sell, the NHG will cover the debt that’s left — this is when the selling price is lower than the mortgage amount due.

The NHG will cost you 0.6% of the mortgage amount in 2024. However, you’ll earn your money back quickly because lenders offer much lower interest rates if you opt for the NHG when sealing the deal on your Dutch mortgage.

It’s not an option for everyone, though. In 2024, the NHG is only available for mortgages in the Netherlands that are a maximum of €435,000.

However, if you want to use your mortgage to make energy-efficient changes to the home, then the NHG maximum is increased to €461,100 in 2024.

Good to know: The 0.6% is tax-deductible!

In short, with the NHG, you’ll pay less per month since the mortgage rate is lower, you’ve got a guarantee for the worst-case scenario, and you can deduct the cost from the taxman.

7. I want a Dutch mortgage! Where do I start?

Ok, you’ve read this article, and now you’re thinking: “Hey, maybe I can get a mortgage in the Netherlands, it’s not the distant utopia I first thought!”

So how do you get started? There are two steps that you can take:

Step 1: Get a rough idea of how much you can borrow for a Dutch mortgage.

You can’t be buying a house without knowing your budget! There are plenty of deciding factors that determine your mortgage amount, and often, there’s more possible than you would think.

Step 2: Reach out to a mortgage advisor

Next up, speak with a mortgage advisor to get an idea of your personal situation. A mortgage advisor works with you to find your ideal mortgage, is an intermediary between you and the bank, and helps you with all the steps involved.

When it comes to choosing a mortgage advisor, it’s best to opt for someone who understands the complexities of being an international trying to get a Dutch mortgage.

This is literally the everyday job of the team at Expat Mortgages. Schedule yourself a free appointment to calculate and walk through your mortgage options.

Have you been through the process of getting a Dutch mortgage? Tell us about your experience in the comments below!

Very enlightening, thank you!

I find it interesting, as well as frustrating, that nobody mentions the fact that the age of the person has an effect on mortgages in the Netherlands, and the problems for expats who are within 10 years of retirement.

Hello,

Do you know whether the constraints relaxed a bit since 2018?

Many thanks

Xavier

Another important missing topic is that it is necessary that you need an income in euro, not in an currency like the US dollar. That is because of European legislation. In order to protect you as a customer, banks are not allowed to provide mortgages in another currency than the currency of your income. Dutch banks cannot handle currency risks in their standardized mortgage products. The banks all choose to offer mortgages in euro only.

For people working for international companies with salaries not in euro, a change in their contract often is the best solution. So you’ll might work for the Dutch subsidiary for the time that you work and live here in The Netherlands.

Nothing is mentioned about letting out the house one buys as one is working in an EU country. Is that possible? are there different rules in each bank? how does it work?

Nothing is mentioned about letting out the house one buys as one is working in an EU country. Is that possible? are there different rules in each bank? how does it work?

+1 on this question!

What is the length of a mortgage? Can you get a 25year term for instance?