Let me guess, like many other expats, you arrived here, snapped up the cheapest contents and liability insurance policy in the Netherlands you could find, and called it a day. But did you know that insuring your stuff can be easy? And affordable? No need to get up, just open up your phone and allow us to introduce you to Lemonade.

No, not the drink. Lemonade is the new kid on the insurance-block. Initially from the United States, this company arrived in the Netherlands with one goal in mind: to make friends with all the digitally native, bicycle-toting Dutchies and expats. Lemonade is looking to fill the gaps in your coverage that were too difficult to fill yourself (no judgement here, Dutch bureaucracy can be overwhelming.)

| DutchReview teamed up with Lemonade to bring this article (and because they know quite a bunch more than us about insurances) |

What is Lemonade? Cover yourself for damages in the Netherlands

Ok so, let’s imagine you have settled into life in the Netherlands — you’ve registered at your local municipality, opened up a Dutch bank account, found yourself a decent health insurance and maybe even applied for some lovely toeslagen.

You probably felt that was enough, but did you know you can insure things like your phone and bike from €2 a month? Or you can cover yourself for any damages caused if you cycle face-first into the back of a market stall? (It happens to the best of us, but by us, I mean me, and by market stall, I mean police officer.) Lemonade offers contents and liability insurance for precisely these situations.

What is covered by Lemonade’s contents insurance?

Lemonade’s contents insurance covers items that are usually kept in your home should they become damaged. “Yes,” you’re probably thinking, “what has that got to do with me” as you look at your lone mattress and second-hand table and chair. Lemonade knows exactly what you’re thinking, and that’s why this policy also covers your phone and even your bike!

Your mobile phone will be covered both inside and outside of the house for damages caused by things such as fire, vandalism, burglary or windstorms (handy for those days when Dutch weather tricked you into thinking it will be fine to head outside without sufficient weather-proofing.)

However, there are some cases where your mobile will not be covered: Lemonade’s content’s policy is slightly different when it comes to mobile electronics like smartphones, laptops, or tablets:

- If you accidentally drop and break your own belongings, they won’t be covered.

- But if the items belong to a third party, they will be covered by liability insurance.

Nevertheless, if you need extra protection e.g. for your phone and bike, the company made sure to include an anti-theft add-on in its contents insurance. This covers all your belongings against theft inside and outside your home, even when you travel around the world.

According to Lemonade’s Policy 2.0, this means — for your bike for example — that as long as you use an ART approved lock (ART is a foundation that rates bike locks) with at least a two star rating, your bike will be covered should someone decide to take it for a late night joyride.

What is covered by Lemonade’s liability insurance?

Ok great, let’s say you are happily cycling along the canals, head in the clouds, contemplating the picturesque turn that your life has taken when BAM — you knock the side-mirror off of poor oma’s mobility scooter.

It’s fair to say it was your fault, you weren’t looking, and now oma has a broken side mirror that needs paying for. Lemonade cannot help you to translate the tidal wave of Dutch profanity that crosses that poor woman’s lips, but it can help you to cover the cost of damage you may have done.

Lemonade’s liability insurance covers you for damages to someone or their property. You can either choose a €1,250,000 liability coverage or a €2,500,000 option.

However, you are not covered for damages if you were borrowing someone’s stuff, and you break it. Borrowed Jeroen’s snazzy mountain bike and crashed it? That’s on you my friend.

Here’s why I think Lemonade is a great choice — My personal pros

As an expat, there are many reasons why I would choose Lemonade. This insurance has much more to offer to the next generation of adults and expats in the Netherlands. They’ve taken into account our shift in values to offer us an experience different from any other insurance company. What on earth am I talking about? Let’s get into that.

It’s all remote: meet Lemonade’s AI innovation

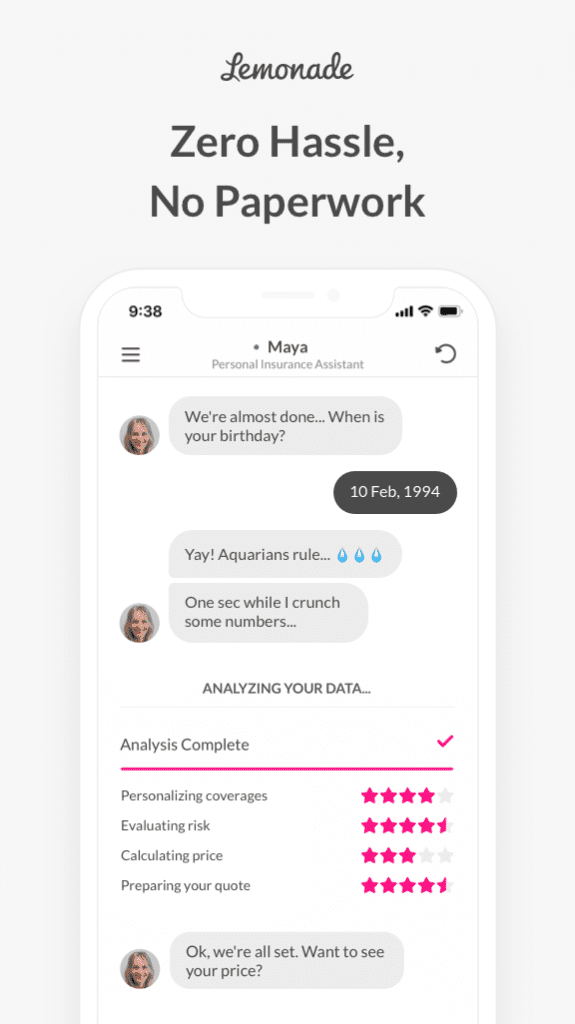

Ah the word “remote,” I swear it will trigger flashbacks to days spent staring at your wall as you schedule your next Zoom meeting. If there was ever a year to introduce remote insurance, it’s 2020. That’s exactly what Lemonade did. Everything is digital with no physical paperwork involved.

Signing up

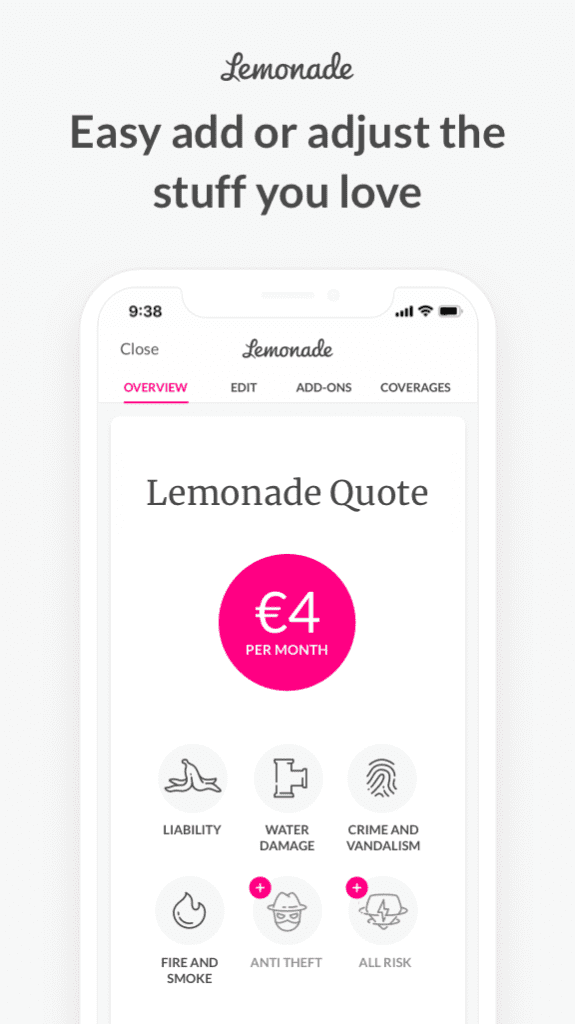

Looking to set yourself up? Simply take out your phone or laptop and tell Lemonade’s AI, Maya what you would like to cover. Maya will ask you a couple of questions before showing you your personalised quote that you can edit according to your own preferences (such as the deductible, start date, coverage amounts and more).

Filing a claim

All setup and ready to file a claim? Again, simply take out your phone, hit the claim button and tell AI Jim what happened. Whether it’s three in the afternoon or three in the morning, the AI bot is always there for you. Lemonade can also pay claims instantly — in fact, around a third of their claims are handled straight away.

But don’t worry, if AI Jim can’t work out whether or not to compensate you, a real person will take over handling the request. Either way, you won’t have to step outside your door to make your claim, and if you can be compensated, you will receive the payment directly into your bank account.

Lemonade: expat friendly insurance for life in the Netherlands

Starting off a life in the Netherlands comes with many challenges for expats, Lemonade took this into account when it arrived in the country and so, it’s services are offered in both Dutch and English.

This is great if the Dutch language is completely new to you and you feel more comfortable speaking English. You can select coverage for the Netherlands but still do everything through a language that you actually understand. How many Dutch insurance companies can offer you that?!

No more Google translate and no more worrying about whether or not you interpreted something correctly, you can make claims and interact knowing that nothing will be lost in translation. Once you hit that button, all correspondence with Lemonade will be carried out through English, no translation needed.

Lemonade’s ethical approach to insurance

Thought the innovation stopped there? Nope, there’s more, and it’s just as impressive. Lemonade takes a fixed fee. This means that they take a fixed percentage of money from your monthly payments.

The rest is used to pay claims — and whatevers leftover is donated to a number of charities that the customers can choose from. So unlike traditional insurance companies who are perceived to be making money when denying claims, Lemonade doesn’t benefit from fewer payouts — you’re safe!

Nobody’s perfect — my personal cons

We like to keep it real with you, so here are some reasons why you might be reluctant to take out insurance with Lemonade.

Lemonade: It’s all online and that’s not always good

Yes, we did list this as a pro, and in our current situation remote interaction is great! But sometimes you like to have a paper trail and not just know that your claims and premium are somewhere out there in the ether.

No physical branch

There’s no physical branch that you can point a finger to when you need to just look someone in the eye and ask them a question, which can be off putting for some (but great for introverts!) The only way to access Lemonade is through a device and wifi. However, this means also that Lemonade is accessible anywhere, anytime from the comfort of your sofa.

Speaking with AI

Whilst Lemonade’s AI is great for getting you insured quickly and adjusting your claim hassle-free, some people just need to feel assured by a human. AI technically eliminates room for human error, and helps to make insurance fairer by vanishing bias — but some people just want to know that their personal stories are being heard and handled by another human (I feel like I’m in some sort of dystopian future writing this.)

Perhaps you’re old-school and will miss all the poor mustachioed insurance men who will be unable to step inside your house and throw a few insurance policies your way! However, rest assured you can always reach out and talk to Lemonade’s Claims Team, and have your case reviewed by a (human) specialist if needed.

Sign me up! What are my options with Lemonade?

If you’re impressed by all this, sign up is simple, just head on over to Lemonade’s website and tell Maya what you would like to cover. You can customise your policies so what you pay really depends on your own personal situation, but here are the starting prices for 2020:

- Contents insurance starts from just €2 per month

- Liability insurance also starts from €2 per month

- Contents and liability insurance together starts from, you guessed it, €4 per month!

There are a number of variables that are taken into account when determining your price, such as whether you live in an apartment or house and whether or not you have ever made any insurance claims in the past.

Want to know more about Lemonade?

Curious as to how it all works? Lemonade offers an easy and comprehensive rundown of how they operate on their website.

Sometimes life gives you crises and you need to turn to Lemonade. Are you ready for your new life in the Netherlands?

Feature Image: DutchReview/Supplied.