Sometimes, all you need is for an expert to sit you down and tell you what to do — especially when it comes to getting a mortgage in the Netherlands. So, that’s exactly what we asked for.

We spoke with one of ING’s mortgage experts, Mark Heukels, and asked him to give it to us straight: what are his tips for internationals who want to get a mortgage in the Netherlands?

Here’s what he had to say.

1. Sit down with a mortgage advisor before you do anything

“The main thing I always say to expats is that you should have a mortgage expert help you,” Mark tells us.

Why? “When you’re going through the process of getting a mortgage in the Netherlands, having an expert by your side can be invaluable”, Mark explains.

“They can provide practical tips and tricks, guide you on what to consider during the bidding phase, and highlight what to pay attention to in the purchase agreement.”

On top of this, once you have found your dream home, you only have a matter of days to get a bid ready in this crowded housing market. When the time comes, you need to know exactly what you can and cannot afford to offer.

As Mark says, “You need to know your manoeuvring space.”

This is why ING offers expats in the Netherlands free consultations with a mortgage expert.

READ MORE | Types of mortgages in the Netherlands: Dutch ‘hypotheken’ explained

By sitting down with one of ING’s experts before starting the process of finding a house, you’ll gain insight into what you can offer to a potential seller during the buying process.

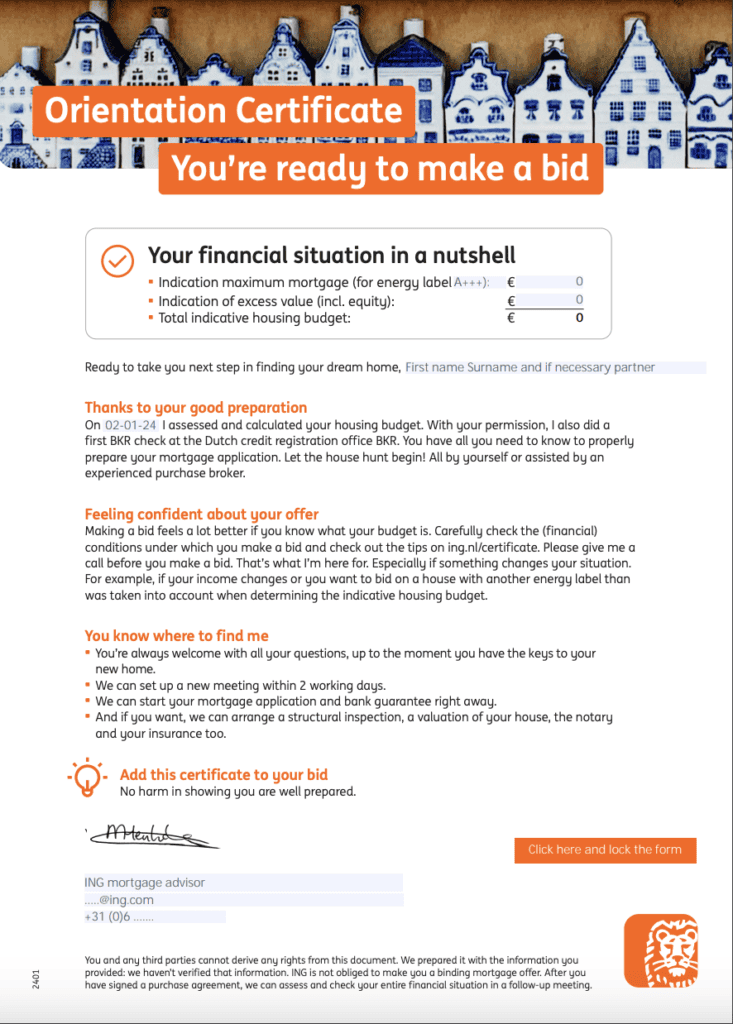

One very handy way that they do this? ING’s expert can prepare a certificate presenting your maximum mortgage.

Not only will this help you prepare, but it will also make you stand out from other bidders.

Ready to find out what your maximum mortgage is to buy a house in the Netherlands? Sit down with one of ING’s mortgage experts.

2. Gather all the relevant documents

The above certificate is not the only thing you should ensure you have before you set off on your journey to becoming a homeowner.

“Before you attend your free consultation, you will be asked to upload documents such as payslips, an employer’s statement, and your pension information”, Mark explains.

However, during your meeting with the expert, you will be advised on what further documents you need to gather to ensure the mortgage process moves as smoothly as possible.

“Later, for example, you may be asked to provide a signed residence permit and your past three years of income if you are a freelancer (ZZP’er),” he tells us.

You don’t want to find yourself scrambling for these while a seller or a bank taps their foot.

3. Find your experts beforehand

Speaking of gathering your paperwork, you’ll also have to choose your fighters. Mark suggests that you gather the relevant experts before you start anything.

You don’t want to waste valuable time hunting down the relevant experts once you realise you need them.

For example, have you found a notary yet? This can be a time-consuming process, so make sure you complete it before your house hunt begins.

Good to know: ING offers the possibility to make use of a special rate for ING customers via their notary services, making your search easier.

4. Make the most of your cooling-down period

Another tip that Mark has up his sleeve? “Try to use the cooling-down period to your advantage.”

In the Netherlands, once you have signed the purchase contract, you have three working days to change your mind and withdraw without facing any financial consequences.

While many may spend these three days wringing their hands and looking at their bank statements, Mark suggests that you put these three days to good use.

How? By contacting ING and getting your mortgage approved.

“If you arrange to sign the purchase contract on a Monday, you should also arrange that we meet and apply for your mortgage that same day,” Mark says.

READ MORE | Moving to the Netherlands: all you need to know

He explains that, in general, ING only needs three to six days to approve a mortgage application. Armed with an expat desk specifically for internationals applying for a Dutch mortgage, ING can get back to you quickly about your mortgage application.

This means that, if timed correctly, by the time the cooling down period ends, you will know for sure whether or not you have been granted a mortgage.

5. Stay in touch with your mortgage advisor

The speed of your mortgage advisor all depends on something important: whether or not you’ve kept them in the loop about your house hunt.

“If there’s one thing I really have to emphasise, it’s that you should stay in touch with your mortgage advisor,” Mark tells us.

As we all know, in the current Dutch housing market, you have to move with speed. What’s going to slow you down, however, is if you’re not sending regular updates on your progress.

READ MORE | 21 Dutch terms you need to know before you buy a house in the Netherlands

By keeping your mortgage advisor updated on how the house hunt is going, they are ready to pounce if, for example, you need to make some recalculations on your mortgage, or if you need to launch an application for a mortgage.

“Things move faster,” he says. And if there’s anything you’ll need throughout this process, it’s speed.

Unsure of whether you can even commit to a mortgage? Geen probleem, ING’s expat experts are happy to sit down and walk through the options with you.

6. Get a real estate agent involved

When Mark says to involve the experts, he doesn’t just mean his colleagues. He also suggests you seek the help of a real estate agent.

But not just any agent, he says, “you should enlist the help of a real estate agent who knows the neighbourhood and house type you want to buy.”

Just as your mortgage advisor is there to help you get a Dutch mortgage, a real estate agent can give you an estimate of just how much of a mortgage you may need.

Their experience means that they are aware of how much similar houses in the area have sold for, meaning they can help give you and your mortgage advisor an idea of what your ideal borrowing power should look like.

Good to know: A realtor will also be able to arrange for a speedy evaluation and taxation of the house, which will help the mortgage process move efficiently.

7. Curate a personal story when bidding

Of course, a successful journey towards a mortgage begins with a successful bid on your dream house — and Mark has a tip for this as well.

“Curate a personal story when you place your bid, there can be multiple bids that are the same, but if you have a personal story, your bid can stand out.”

READ MORE | The best banks in the Netherlands for internationals in 2024

While the process of trying to find a home can feel quite impersonal at some points, at the end of the day, we’re all human.

Think of how your story will stand out from the crowd, prepare a draft, and when the time comes, you will have a personal story that you can tailor to the home you’re bidding on.

Moral of the story? Don’t be afraid to seek guidance from the experts when you decide it’s time to buy a house in the Netherlands.

Do you have any more tips for the mortgage process in the Netherlands? Share them in the comments.