If there’s one thing I don’t want someone lecturing me about, it’s which stocks to invest in. However, what I do want to know, is someone’s experience with investing in stocks — so here’s mine.

I decided to try out investing with the online investment broker, Scalable Capital. Let me tell you how I found it.

Firstly, what’s Scalable Capital?

Scalable Capital is a website and app that allows you to invest in a number of different ways. You can choose from investing in stocks, ETFs, Cryptocurrencies and funds — all from one account.

However, there’s much more to it than that. Scalable Capital offers its users multiple smart tools to help them make better financial decisions — but more on these below.

Note: It goes without saying that there are risks associated with investing.

Why did I choose Scalable Capital?

There were four main reasons why I decided to try out investing in stocks with Scalable Capital:

I’m a ZZP’er, so I need to be smart about savings

Firstly, I’m a freelance writer — which means I need to be smart about my money.

I don’t have a pension plan set up for me, so making sure my savings continue to grow is very important.

One way to try and prepare for a better financial future is by looking into investing — so I needed to find a platform that would enable me to do this.

Scalable Capital’s affordable packages, easy-to-use app, and multiple investment options will allow me to try my hand at investing and see what it can do for my savings.

Scalable Capital is trustworthy, and I need that

Another big selling point of Scalable Capital is that it has been tried, tested, and reviewed.

I’m not going to start investing using a platform that I don’t trust. A quick Google search showed me that Scalable Capital has a 4-star rating and has convinced over 600,000 users since it launched in 2014.

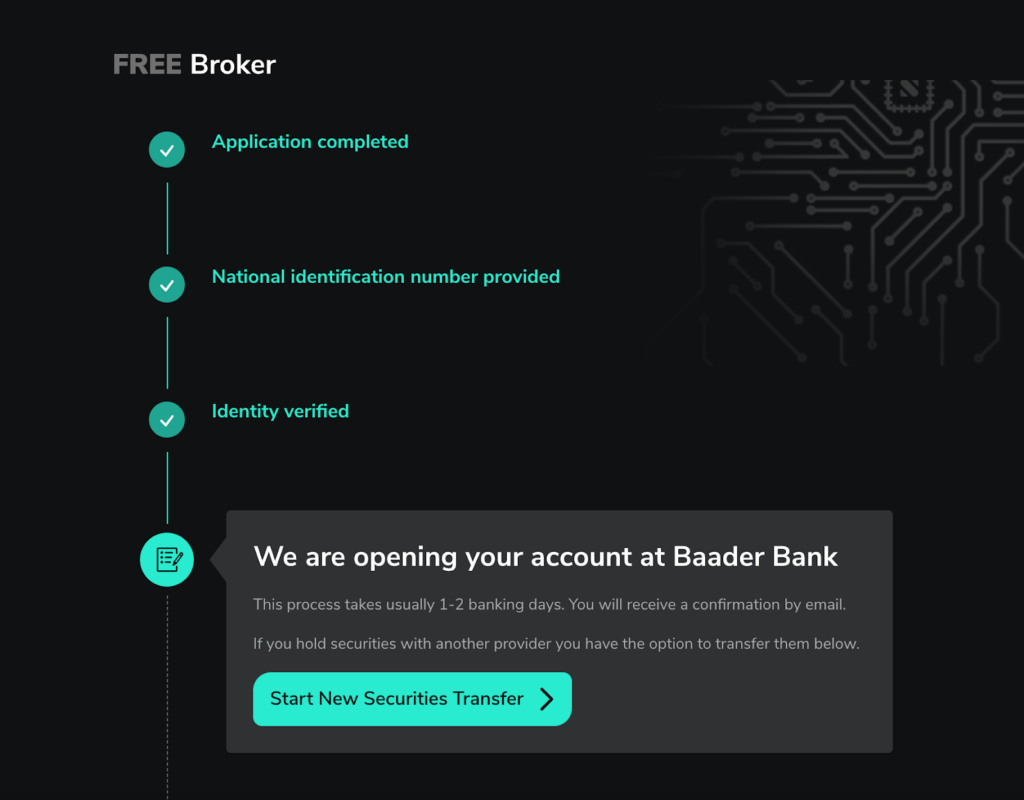

Scalable Capital also has a German custodian bank (Baader Bank), meaning my money is protected under the European Deposit Guarantee Scheme.

This means that should anything happen to the bank my money is held with, my deposit will be guaranteed up to €100,000.

Note: The Deposit Guarantee Scheme only applies to money deposited with Scalable Capital, not money invested with Scalable Capital.

I want to fight back against inflation

If there’s one thing I worry about when it comes to my savings, it’s inflation.

Unless I find a way to allow my savings to continue to grow and gain value, inflation is going to gradually decrease the value of the money I’ve worked so hard to save.

READ MORE | The best banks in the Netherlands for internationals in 2025

Not only is Scalable Capital a platform that will enable me to invest my money and give it the chance to grow, but they are also currently offering 2.25% interest on the money you deposit with them.

I can choose to invest in ETFs if I want

What I also like about Scalable Capital is that once I have mastered the art of investing in stocks, I’m not limited to just that. I can also choose to invest in Exchange Traded Funds (ETFs), for example, all from the same account.

With no need to hop from one service to another, I can use my one account to invest as little as €1 in the over 2000 ETFs that are available on Scalable Capital.

While Scalable Capital offers me the room to try out investing, it also allows me room to go further once I get comfortable.

Here’s how it went

So, how did it work once I decided to invest with Scalable Capital? Let’s talk about it.

The setup: nice and easy

The first thing I noticed with Scalable Capital was that the app is very user-friendly, making it easy for me to set up an account.

There were three steps I had to complete: Select a package, give my personal details, and confirm my identity.

I input my personal information, which included details such as my date of birth, address, and BSN.

Scalable Capital then made sure to confirm my identity. I was asked to take two pictures of my passport (one straight on, one tilted), send a selfie, and send a video of myself following prompts.

While this may seem like a lot of effort, I appreciated it; at least I know that they take their customers’ security very seriously.

I then waited for my identity to be confirmed by Scalable Capital before I could proceed any further, which took about 2 hours. Once that was done, my account was ready to go within 24 hours.

I chose a broker

I could choose between two different plans: Free Broker and Prime+ Broker. Let’s quickly run through what these different packages offer:

- Free Broker — This is the best option if you’re just dipping your toes into the world of investing. You pay zero subscription fees and instead pay €0.99 per trade you make (investments made through savings plans are commission-free). You also receive 2.25% interest on up to €50,000 deposited.

- PRIME+ Broker — At just €4.99 per month, you can gain access to all tools and analytics, have a trading flat rate and enjoy interest rates on your deposit. You receive 2.25% interest on up to €500,000 deposited.

The main difference between these packages is the amount of smart tools and benefits you can make use of when investing.

For example, once you pay for Scalable Capital’s PRIME+ Broker, you can receive helpful portfolio analysis, set price alarms so you know when it’s best to invest and gain access to more portfolio groups.

READ MORE | Scalable Capital: why this investment app is the way to go for expats in the Netherlands

I chose to begin with Scalable Capital’s FREE Broker. This way, I could first explore what I wanted to do with the app and see what tools I needed access to.

However, if you opt for Scalable Capital’s PRIME+ Broker, you get a trading flat rate, and full access to the portfolio analysis tool Insights, powered by BlackRock.

I bought a stock

Once I had my identity confirmed and my Free Broker subscription, it was time for me to bite the bullet and try out investing in stocks — and with Scalable Capital, I have over 8,000 stocks available to choose from.

To start, I decided to deposit €2,499 in my Scalable Capital account, which, together with the initial €1 deposit (for verification purposes) gives me €2,500 to invest.

I then chose to invest in ASML — but you should make your own educated decision! This is just for illustrative purposes.

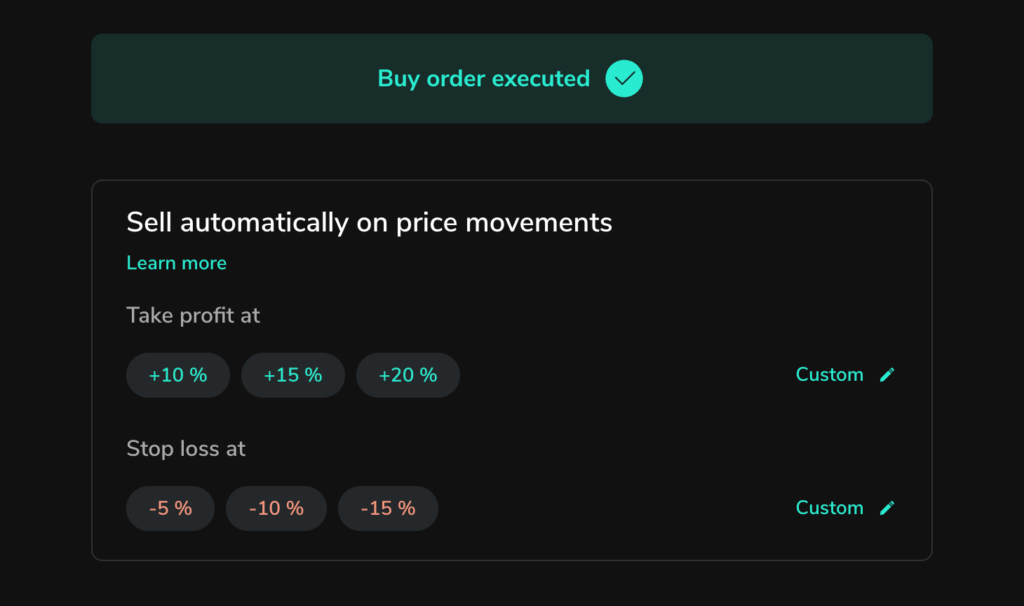

The cost of one stock in ASML was €861 at the time of investing. However, I also had the choice to include a STOP or LIMIT order.

By placing a LIMIT order, I am essentially making sure that should the price of the stock suddenly jump up from €861 to €870 while I’m trying to buy it, the sale won’t go through. This prevents me from accidentally paying more than I want for the stock.

READ MORE | Dutch savings accounts: Best interest rates in the Netherlands

With a STOP order, I could ensure that I buy the stock once it reaches, say, €900. Should the stock price increase to this number, I will automatically buy it.

With FREE Broker, I pay a transaction cost of €0.99 per order on stocks. I can see these costs displayed in the app before confirming the order.

What I found super helpful about the buying and selling process was that I could actually set limits at which I would like to sell the stock.

For example, I could choose to sell the stock if I was making a loss of 15%. Similarly, I could choose to sell the stock if it went above a certain percentage of profit.

Note: With Scalable Capital, it is only possible to make fractional stock purchases using their savings plans.

I can start a savings plan

Speaking of savings plans, these were a huge selling point for me.

Scalable Capital offers savings plans to all its users. With these, you can set up an automated investment plan.

For example, you may decide that at the end of each month, you want to invest €50 in stocks. There are a number of reasons why I like this tool:

- It’s automated, I don’t have to do anything (yay!)

- I don’t pay any order costs

- I can invest as little as €1

- I can buy fraction stocks

- You enter the investment market at multiple moments (distributing your entry risk)

One question that always haunts me about investing in stocks is, “when is the right moment?” With savings plans, you choose not one single moment, but a long series of moments to enter the market. This is called dollar-cost averaging.

Time in the market beats timing the market, so this allows you to start today and reap the benefits of compound interest.

For example: Say each month you invest €100 — no matter whether the stock market goes up or down — because you believe that long term, the market will go up. If it goes down momentarily, this same €100 will allow you to buy more units, bringing your average purchase price down.

Look at that, she’s stock market smart. 💁

I watched my investments grow

Once I set myself up and have chosen what I want to invest in, it’s time for me to sit back and let my money do its thing.

Using features such as Scalable Capital’s savings plans, I can take a hands-off approach, while also knowing that I will stay informed by using the app’s alerts and automations.

That being said, I like to keep an eagle’s eye on my money, which is why I enjoy the app’s simple and clean look.

During my research, I also came across a service called justETF. Acquired by Scalable Capital in 2021, this platform offers access to an ETF screener as well as to an Academy, both very helpful for people who are new to investing — and it’s all for free!

Ready to try investing for yourself? Scalable Capital can guide you on your journey. Simply sign up and get started!

Have you invested with Scalable Capital before? Tell us about your experience in the comments below!

Even zien of dit werkt.