As an expat in the Netherlands, I’m juggling many balls at once: I need to keep up with family back home, learn a new language, get enough sleep, watch my posture — oh, and make sure I start investing while I’m still young.

Honestly, I don’t have time to worry so much about what my Dutch savings are doing, but it’s important that I’m smart with them.

So, instead of letting my money sit around and lose its value, I’ve decided it’s time to let it grow — with Scalable Capital.

Here’s why I think Scalable Capital is a great option for expats in the Netherlands who are looking to start investing, much like myself.

Firstly, it’s one of the most affordable options out there

Scalable Capital is one of the most affordable online financial brokers out there, which is a big plus for me.

If I’m just getting into investing, I don’t want to be paying big bucks just to try something out. Scalable Capital offers free and affordable plans that I can enjoy without making any big financial commitments.

READ MORE | The best banks in the Netherlands for internationals in 2024

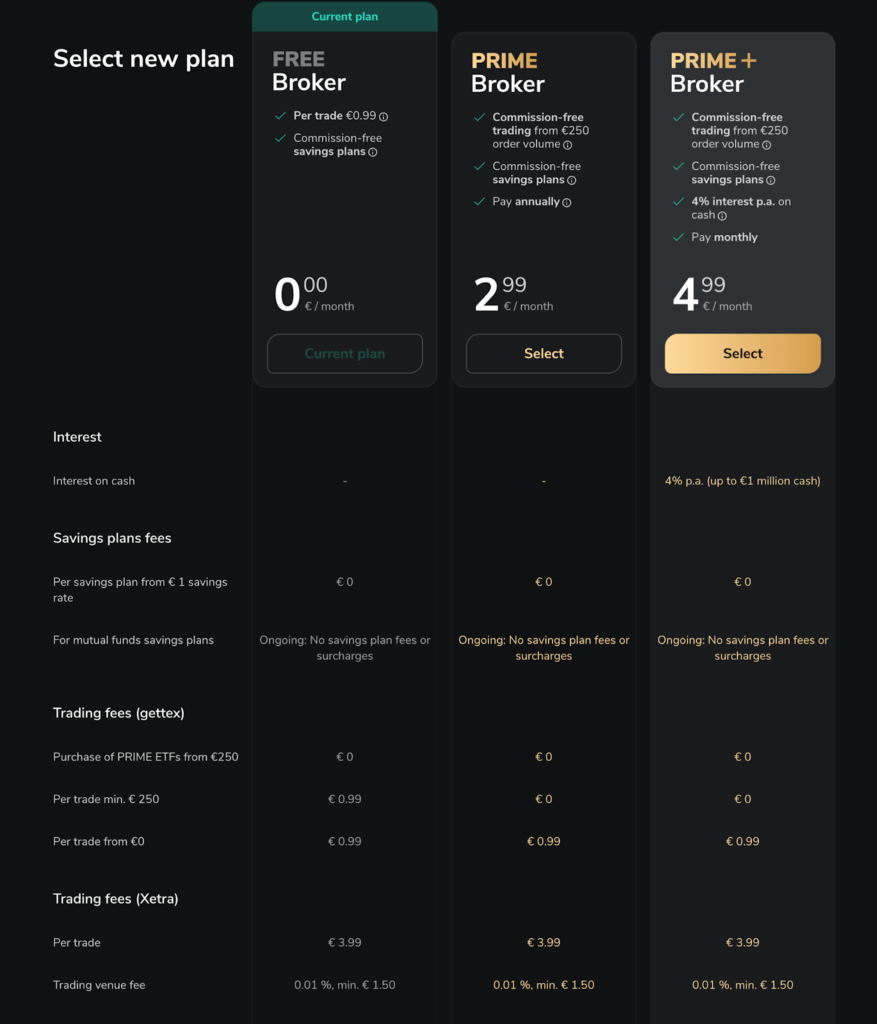

With a free subscription option and paid plans starting at just €2.99 per month, Scalable Capital doesn’t ask for much from you as a customer.

Depending on your preferred investment strategy or the amount of money you want to put into stocks, Scalable Capital offers different plans:

- Free Broker — This is the best option if you’re just dipping your toes into the world of investing. You pay zero subscription fees and instead pay €0.99 per trade you make.

- PRIME Broker — At just €2.99 per month, this is a great option if you’re looking to benefit from unlimited access to portfolio analysis, price alarms and more.

- PRIME+ Broker — At just €4.99 per month, you can currently enjoy 4% interest rates p.a. over 4 months on your non-invested cash.

What’s more, if you opt for a paid subscription, Scalable Capital lets you invest commission-free for order volumes over €250. Opted for the FREE plan? No problem, savings plans starting at €1 are also commission-free — other orders are just €0.99.

Note: It goes without saying there are risks associated with investing.

It provides a wide variety of investment opportunities

If you’re not new to the world of investing and want to have a taste of different investment options, you’ll be happy to know that you can do a lot with your money using Scalable Capital.

The Scalable Capital app allows you to invest in not only individual stocks but also ETFs, Cryptocurrencies, commodities and funds — all from one account.

The power of Scalable Capital in the first instance is in its simplicity. Besides showing you stocks, you also get the option to buy crypto, check your watchlist of stocks and your recent transactions.

Depending on the plan you choose to take out, you can enjoy several smart tools in order to easily invest in a number of ways — but more on this below!

Note: Scalable Capital is available in the Netherlands and five other European countries but not globally.

It makes investing simple with smart tools

Unless you’ve studied finance, investing can feel like unchartered territory — especially when you’re doing it from a country that you may be unfamiliar with.

That’s why it’s important to invest using a platform that can protect you from making risky investment decisions.

Scalable Capital can help you out in this by providing you with all the tools you need to make smart investments.

READ MORE | Dutch savings accounts: Best interest rates in the Netherlands in February 2024

For example, if you’re not sure whether you want to invest in a particular stock, no problem: you can use Scalable Capital’s Watchlist tool. With this, you can keep an eye on how things develop and invest when you feel confident.

You can also make use of Scalable Capital’s Securities lists, which give you insight into the latest investment trends and point you to popular savings plans. This makes sure you’re not going in blind.

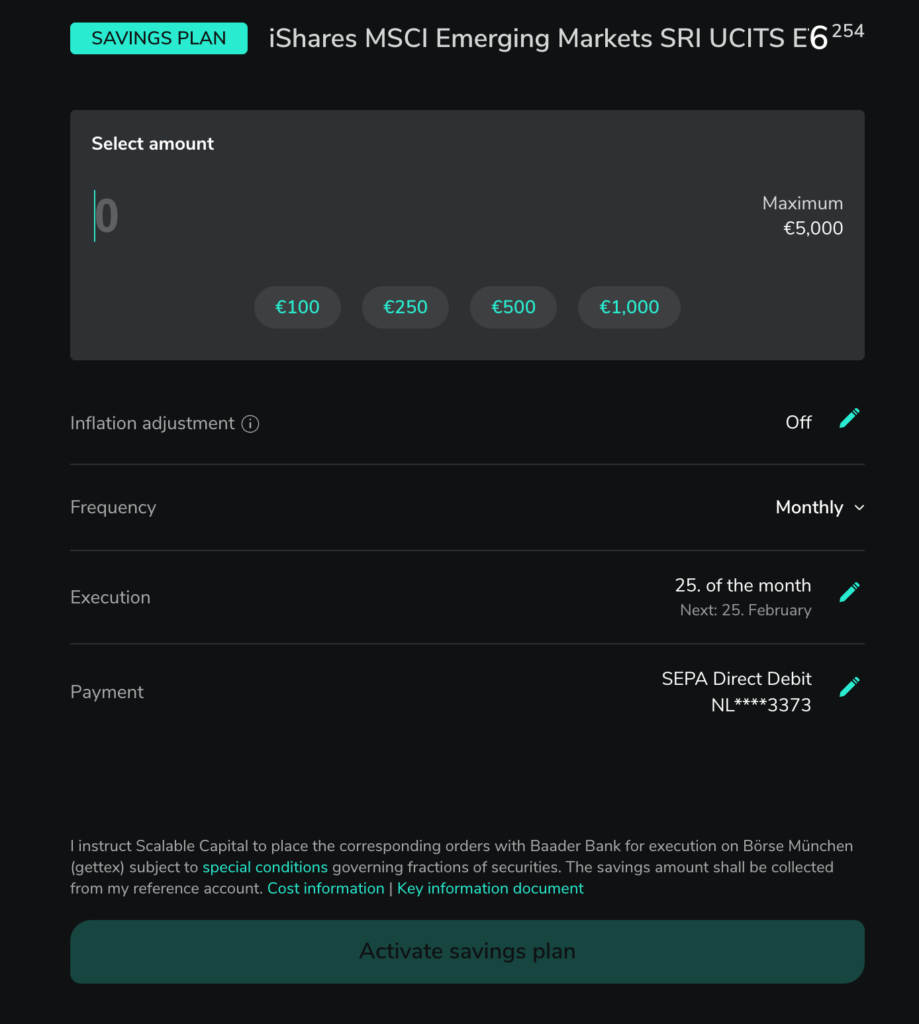

You can opt for an automated savings plan when life gets busy

Speaking of savings plans, this is a big selling point of Scalable Capital for me.

My life in the Netherlands is busy; I don’t have time to read three books on the stock market.

Sometimes I just need someone to lay all the information out in front of me, simplify it, and give me the tools to take action if I want to.

Scalable Capital can do this for me with its automated savings plans.

With these plans, you can arrange to automatically invest as little as €1 per month in ETFs, stocks, funds, or crypto. The amount will be automatically deducted from your account every month and invested in a preselected portfolio.

Want to do it all yourself? You can make use of Scalable Capital’s helpful features, such as price alerts, financial ratios, and watchlists, to decide how you want to invest.

It gives you the chance to try out investing — without risking it all

While you can do a lot with your money on Scalable Capital, the good news is that you also don’t have to.

Scalable Capital is a great way to try your hand at investing by starting off small — and paying low prices in return.

With Scalable Capital, you can invest as little as €1 per month if you’re a bit apprehensive and would first like to dip your toes into the world of investing.

Another big selling point for me is the fact that with Scalable Capital, your money is protected under the European Deposit Guarantee Scheme.

This means any money that you deposit with Scalable Capital is protected up to €100,000.

Note: This scheme doesn’t cover money lost through investments made on Scalable Capital.

It offers decent interest rates for your hard-earned savings

In the Netherlands, it’s hard to find somewhere to put your money where it will actually have the chance to grow.

Not only can Scalable Capital offer you the chance to invest your money, but if you sign up for their PRIME+ Broker account, it also allows you to deposit your money with a whopping 4% interest.

This is much better than ABN AMRO’s 1.5% interest savings rates, for example.

Note: Scalable Capital’s offer of 4% interest only applies for four months, up to €1 million. After four months, this drops to 2.6% variable interest, on up to €100,000.

It’s a trusted service

If there’s one thing you need when you decide to start investing, it’s a trusted service with good reviews.

Of the 600,000 users across Europe that use Scalable Capital, many seem to be happy with the service, with over 40% of users rating it with 5 stars on Trustpilot — that’s what I like to see.

During my research, I also came across a service called justETF. Acquired by Scalable Capital in 2021, this platform offers access to an ETF screener as well as to an Academy, both very helpful for people who are new to investing — and it’s all for free!

In this economy, it’s important as an expat in the Netherlands to do what you can to help your savings grow. In my case, Scalable Capital is one way I can try this out.

Are you ready to give Scalable Capital a try? Great. Simply pick a package and sign up on their website.

Have you invested using Scalable Capital before? Tell us about your thoughts in the comments below!