Doing your taxes in the Netherlands as an expat is complicated: you’re getting used to a whole new country, the system is probably different from what you’re used to, and different rules apply to you than to the average Dutch citizen.

It’s really important to get your tax affairs in order: you might save money, or at the very least, avoid a series of unpleasant blue letters from the Belastingdienst. So how do you file your taxes in the Netherlands as an expat? What situations and life changes affect what? And what on earth is an m-form?

With the help of expert tax consultants J. C. Suurmond and Sons, we’ve put together a comprehensive guide to the ten main things you need to know about taxes as an expat in the Netherlands. So fasten your seatbelts, and take out that folder of crumpled receipts, because we’re about to sort your life out in one single article.

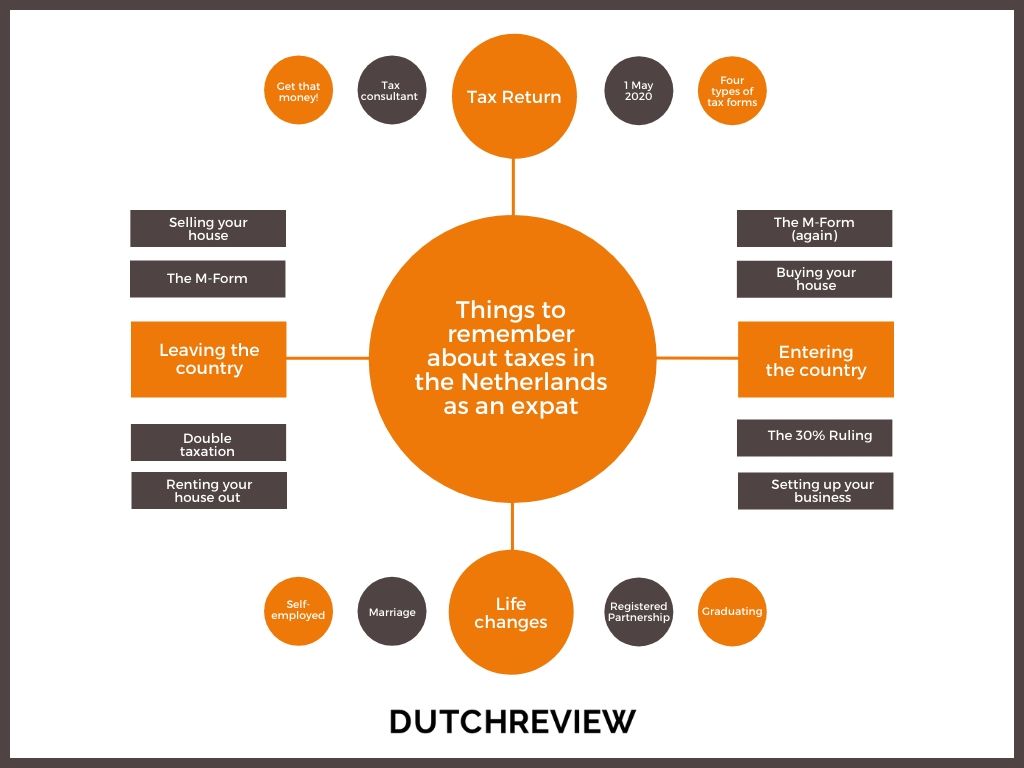

1. The Tax Return in the Netherlands for expats

No-one likes realising they could have got money back from their taxes, but didn’t, so first things first, let’s talk about tax returns. Basically, when it comes to tax returns, you’re always filing for the year before in the current year. So, the next time you file your tax return will be in May 2020, but that tax return will be for 2019. Fun. Wonderful. We love how everything is so clear.

Most of the time you will receive an invitation from the government to file your tax return, but even if you don’t get one of these, that doesn’t mean you’re ineligible. If you’re not sure if you should bother filing a tax return, talk to a tax consultant like J. C. Suurmond and Sons. They can advise you of the possibilities for getting money back. And if the company you work for is already filing your tax return for you, there’s no harm in getting a second opinion.

This is all basic stuff that applies to all people in the Netherlands, expat or not. But if you are an expat, then there is a bunch of extra stuff to take into consideration. People entering the Netherlands need to file an m-form, which is a longer, more complicated version of the regular p-form for tax returns. An m-form has to be submitted on paper, it’s only available in Dutch, and it’s complicated. It’s basically the number one reason to get a tax consultant involved: they can fill out and file your m-form for you, and make sure you’re not missing any opportunities to lower your tax burden.

2. What is a tax consultant and do I need one as an expat in the Netherlands?

We wanted to explain what a tax consultant is, and why hiring one would be totally worth it. Honestly, when you’re dealing with something as serious and financially impactful as taxes, there’s no reason to hesitate about getting an expert on board to advise you. If you’re wondering what exactly a tax consultant can do for you, we’re going to give you a quick run-down here: but also, throughout the article, we’ll be hinting at different situations where having one on your side would be very helpful.

A tax consultant‘s job is to advise you on your tax situation: to make you aware of your obligations, but also the possibilities to lessen your tax burden, if that’s applicable to you. They also deal with your administrative affairs if you want them to: they can fill in complicated tax documents like the m-form for you, for example. Finally, something the best tax consultants will do is be pro-active in how they advise you: they’ll let you know about ways you can minimise your tax liability before you ask; they’ll cultivate a personal relationship with you; and they’ll quickly be able to provide you with in-depth knowledge of your tax situation.

3. If I’m leaving the Netherlands, or arriving here, what do I have to do as an expat?

When you arrive in the Netherlands as an expat, or when you leave, you’ll need to fill in an m-form. This form comes in two sections, needs to be completed in hard copy, and best of all, is only available in Dutch. Why, you ask? We don’t know. We really don’t. Now, this form is very important, because it decides how much tax you’ll pay on your income of that year in the Netherlands.

The first part of the form is about your situation before you resided in the Netherlands and the next part is all about your situation while in the Netherlands. If you want to avoid double taxation (see below) then you need to be very careful when filling in this form. Just because you were only earning money in the Netherlands for half a year, doesn’t mean that you’ll be only taxed on what you earned in the Netherlands. It gets even more complicated by the fact that some countries or regions are exempt, and others are not. So, uh, take our advice: get a tax consultant like J. C. Suurmond and Sons involved early: it’ll save you a bunch of tears.

4. How do I avoid being taxed twice as an expat in the Netherlands?

As is the case with a lot of expats, you might have income coming from two or more countries, or you might have assets in two or more countries. This means you could get taxed twice, which isn’t fun. If you want to stop this from happening, get a tax consultant on board early in the process. Usually, relief from double taxation comes in the form of a tax credit- but this varies. So does your liability: some assets might not be taxable at all, and others might have to be taxed in both countries, in some situations.

As though that wasn’t complicated enough, different countries have different arrangements for this. For example, if you’re from the US, you’ll remain taxable over there regardless, so a different process will apply. And if you’re here working for an international organisation, there might also be reasons for your tax situation to need further examination. Some international organisations will have special policies on taxation- for example, your pension might not be taxed.

5. I’m self employed/freelance in the Netherlands: what taxes do I have to pay as an expat?

Are you an entrepreneur or self employed in some way? Then your tax situation requires attention. Being self employed usually means you have to file your own taxes, but a tax consultant can take that burden away from you if you decide to enlist one. Even if you’re self employed on the side- you have a side hustle, or something like that- you’ll need to be aware of your tax obligations as a person earning money outside of your regular job.

You might also have decided to move to the Netherlands to give your own business the best possible chance of success: the Netherlands, after all, was voted the most competitive economy in the world recently. Moving to a new country and setting up a new business is a lot. It might be a good time to get an expert on board and get both your personal and professional tax lives sorted out in the bargain.

6. If I’m a student in the Netherlands, do I need to think about taxes?

Now, you might be thinking, I’m a student, I have a negative bank balance, I have never seen a single euro in my life. Surprisingly, you might still need to pay attention to taxes- and not just those pesky little (huge) water taxes. You don’t need to be frightened by this, though: it might actually be possible for you to get money rather than lose it.

Technically, the tuition fees you pay while studying are tax deductible up until 2020. However, because most of us earn next to nothing while studying, the deduction has no effect. If you’re feeling disgruntled, don’t! It might be possible for your tuition fees to be deducted from your taxes once you start earning. However, you need to get the timing right on this one, so ask for help from a tax consultant even during your studies: it’ll put you in a much better position when you graduate and start earning.

And, if you’re a graduate student or pursuing a PhD, there’s even more to think about. After 2012, it’s become easier for you to access the 30% ruling after graduation. To be eligible for this you would need to have come from abroad for your study programme in the Netherlands. As with everything concerning taxes, the earlier you start working on this stuff, the higher the chances you’ll actually get that 30% ruling.

7. What is the 30% tax ruling, and when does it end in the Netherlands?

30 Percent Ruling means that 30% of your salary is paid out tax-free. It generally applies to someone who is recruited from abroad by a Dutch employer, and who has a skill that is scarce in the Netherlands. It’s supposed to compensate for the costs expats will incur if they move to the Netherlands- like travelling back to their home country to see family, relocation costs, and an international school for their children if they should want that.

There are a bunch of conditions for eligibility for this tax break, including making a minimum salary, having lived a minimum distance from the Netherlands before moving here, and remaining employed throughout the five years you’re eligible for this deduction. Also, if you’ve lived in the Netherlands before now, that time will be deducted from the five years you get the tax break. And if you’re noticing we’re emphasising five years, that’s because the Dutch government recently shortened the eligibility period for this tax break from eight years to five.

As you can tell, applying for the ruling can be quite complicated, and needs to be done on-time, so a tax consultant could be very useful (especially given all the other tax things you’ll need to sort out when you move to the Netherlands).

If you start your own BV or work through a payroll agency in the Netherlands, there is a possibility this ruling could apply to you, so it’s worth checking if you’re eligible with someone who knows their stuff.

8. What taxes do I have to pay if I’m buying or selling my home in the Netherlands?

You’ve just moved to the Netherlands, and you’re looking to buy a house. Good decision! If you’re staying a while and can afford it, buying a house will save you quite a bit of money- mainly because all the interest you pay on your mortgage is tax deductible, as well as any mortgage related expenses. The interest rate for mortgages is pretty low at the moment in the Netherlands, so basically, what we’re saying is to avoid renting if you can.

But maybe you’re leaving the Netherlands and you want to know what your options are with regard to selling or renting your property. If you decide to keep the property and not rent it out, sometimes that means you can keep the mortgage interest tax deduction. If you want to sell it, that’s also not a bad idea, because in the Netherlands, there’s no capital gains tax.

All of this is complicated by itself, and only gets more so when you own properties in multiple countries, which is often the case if you’re an expat. So talk to someone who knows what the deal is, whether you’re entering the Netherlands or leaving it.

9. I’m moving in with my partner, what does that mean for tax in the Netherlands?

Maybe you’ve met a Dutchie and you’re planning to move in with them. Or maybe you’re getting married and you’re wondering how your tax situation will change. It’s an exciting time! But also one full of changes. We’re not going to tell you how to get your partner to downsize their book collection (because we think they shouldn’t) but there are a couple of tax issues you should be aware of.

First of all, in the Netherlands, there are a couple of different arrangements you might come to with your partner when you know they’re the one: you might marry them, sign a cohabitation agreement with them, or register your partnership. Each of these carry different tax arrangements, and there is even variety within each of these three agreements. Although it’s not exactly romantic, it’s so important to have your tax affairs in order when you’re combining your life with someone else’s: so before you celebrate with friends and family, get your tax situation checked out by a tax consultant.

10. Basically, a tax consultant will make your life easier

If you’re an expat and you’ve recently moved to the Netherlands, you have enough on your plate without stressing out about whether you’ve filed an m-form correctly. And unfortunately, your taxes aren’t something you can simply reassure yourself about blindly: they’re really important. You could be getting money back each year from your tax return, or getting 30% of your income tax free if you have your affairs in order and know your options. That’s why it’s a really great idea to get a tax consultant, if you think it might be helpful for you to no longer have the stress of taxes on your mind. J. C. Suurmond and Sons are a fantastic option if you’re in the market for a tax consultant: they’re able to offer you personalised, proactive tax advice whenever you need it. They’re also a family-run business, run by a father and three sons, so you can expect a personal touch from people who really know what they’re doing.

And if anything, they need to be credited with explaining Dutch tax matters to us for this article, which is quite an achievement by itself!

How has your experience of doing your taxes in the Netherlands been? Let us know in the comments below.

Featured Image: Anthony Shkraba/Pexels

I am analyzing my business opportunities in the Netherlands. Thanks for the helpful article. It is important for me to know about all expenses and taxes.