Revolut is a strong contender for a business banking account in the Netherlands. This neobank is jam-packed with handy invoicing features, seamless Tap to Pay transfers, and convenient app integrations.

Let’s be real: between KvK (Dutch Chamber of Commerce) requirements, Dutch bureaucracy, and banking jargon, opening a bank account in the Netherlands definitely comes with its share of hurdles.

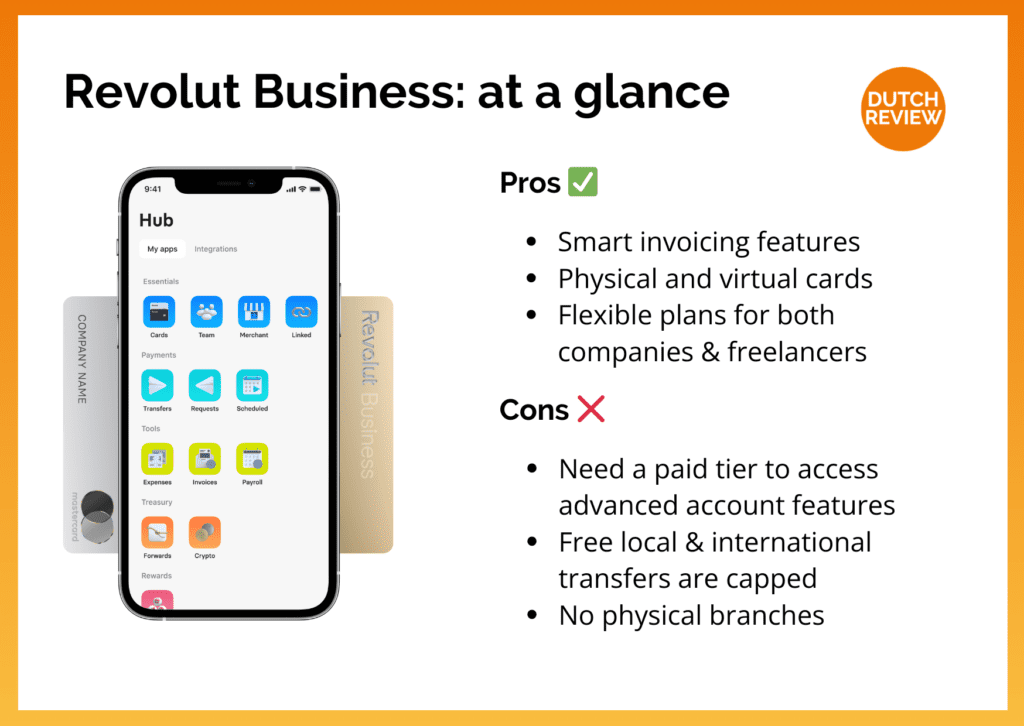

We’ve surfed that wave, so here’s something to streamline the process: a guide to Revolut Business’ pros and cons.

What is Revolut Business?

Revolut is a British neobank with one goal: making the banking process as effortless and hassle-free as possible.

Although Revolut might lack physical branches to make cash deposits, it’s a small price to pay for features like incredible online accessibility, app integrations, and in-app invoicing. (Plus, the app is pretty snazzy looking 😉).

7 powerful pros of Revolut Business

Oké, that’s all lovely, but we’re sure you’re wondering what’s in it for you. Let’s explore some of the ways a Revolut Business account will boost your business! 👇

1. It has smart invoicing features that make accounting a breeze

Hoera, I can’t WAIT to track down my business invoices (said no one ever). It’s a pain, it’s a chore, but it’ll bother you no more with Revolut Business’ handy accounting integrations.

Staying on top of all your payments is now easier than ever with built-in invoicing software that covers everything from card payments to bank transfers.

With multiple payment options supported, your clients can send you money using card payments, bank transfers, or even Apple Pay!

You can also seamlessly export your costs and transactions to Xero, Quickbooks, FreeAgent, or your digital accountant of choice to reconcile your bank accounts in a flash.

2. You can stay flexible with both physical and virtual cards

In today’s fast-paced digital market, the convenience of a streamlined and fully organised financial overview just can’t be overstated.

Thankfully, Revolut Business offers both the ease and greater security of virtual banking cards, as well as the traditional comfort of physical ones.

Should you choose a physical debit card, these come in two forms: plastic and metal. The latter offers customisable branding options, such as adding the company logo on the front, for an extra professional touch.

If you choose to go virtual instead, you can make use of Apple’s Tap to Pay to seamlessly accept contactless payments with your iPhone. Say a big doei (bye) to needing to fill out your account details for every transaction!

3. You can rest assured that your money is secure

Perhaps news of cyber attacks on bank accounts has you clutching your cash in a panic and wondering if switching to Revolut is a safe option.

The good news? All deposits of up to €100,000 in Revolut Business accounts are fully guaranteed. For joint Business accounts, that amount applies to each individual depositor. This means that for 8 depositors, insurance will cover a whopping €800,000.

If banking with your virtual card or iPhone’s Tap to Pay feature sounds like your jam, rest assured that your data is protected by features such as 2FA.

Also known as two-factor authentication, this is a security measure requiring two separate forms of identification to access your data.

So maak je geen zorgen (don’t worry), because your money is as safe as can be!

4. Flexibly-priced plans for everyone, from freelancers to big businesses

Whether you’re a fresh-faced freelancer or you’re at the helm of a large company, Revolut’s ‘Company’ and ‘Freelancer’ plans are flexible enough to suit your financial needs.

READ MORE | Investing in the Netherlands: 7 great apps for getting into stocks

Are you just easing into the business world? You can opt for Revolut’s free plans, with the freedom to seamlessly scale up to ‘Grow’, ‘Scale’, or ‘Professional’ tiers later on as your business expands.

5. You can seamlessly spend as a local in over 25 currencies

Kiss the annoyance of currency exchanges goodbye with Revolut Business’ multi-currency account feature.

Picture this: you’re expecting a transfer from a client on the other side of the globe and you’re wondering when you can expect the glint of fresh money in your account.

Well, if sent from a Revolut account, that cash is likely whizzing over to you at the cost of a domestic transfer, thanks to the bank’s unbeatable exchange rates. 🚀

6. You can work with an unlimited number of team members

With Revolut Business, it’s now easier than ever to control finances as a team.

You can invite as many team members to your account as you’d like to an account, create custom roles, set spending limits, manage permissions, and more.

Oh, and forget about needing to email your colleagues about business expenses and financial overviews! Revolut Business’ convenient app integrations support real-time notifications for community productivity platforms like Slack.

7. Got a question or issue? You can access 24/7 customer support

Let’s face it, tech is finicky. Add finances to the mix and you run the risk of having a Jurassic Park-level issue on your hands.

Luckily, a Revolut Business bank account also comes with its own fleet of superheroes: a dedicated customer service team that’s ready to tackle any issue that comes your way all day, every day.

4 downsides of Revolut Business

If you’ve made it this far, you may be ready and rearing to apply for an account. However, as with any bank, there are pros and cons of using Revolut Business.

Here’s a look at four issues you may run into should you opt for a Business account. 👇

1. You can’t deposit cash

As a virtual bank, Revolut doesn’t have physical branches like Rabobank.

Whilst this isn’t a dealbreaker in the long run, it’s definitely an inconvenience if you’ve made a transaction in banknotes and want to deposit them in your account. Mind you, who does that any more?

2. Adding separate account holders will cost you

Although Revolut Business’ team features are super handy, they aren’t free.

For most tiers, each active account holder will cost you €5 per month in the expenses app and €3 in the payroll app. Depending on the size of your company, those figures could start adding up rather quickly! Of course, if it’s just you and a small team, the features might just be worth it.

3. Free local transfers are capped

If you intend to make local payments, it’s important to note that Revolut Business has a limit on the number of free transfers you can make.

This number will depend on the plan you’ve opted for, with a Free plan hitting a tight limit of five transfers, Grow/Ultimate plans maxing out at 100 transfers, and Enterprise offering customisable limits.

Of course, if you need to do more, it’s not the end of the world: expect to pay just €0.20 fee for each transaction.

4. Free international transfers are also capped

Like local transfers, there are also restrictions on the number of free international transfers you can make.

This number ranges from 5 to 25 based on your plan, with Free and Grow plans offering zero free international transfers. Enterprise, once again, offers you customisable limits.

All international transfers over these limits are subject to a €5 transaction fee.

Types of Revolut Business accounts

Unlike Dutch lunches, there’s no stereotypical format for a successful business. Revolut understands this better than most banks and offers not one but two types of Business banking accounts.

Freelancer

ZZPers and small business owners don’t feel left out because Revolut’s Freelancer plan is tailor-made for you! This plan offers three reasonably priced tiers:

Free

For €0 per month, you get access to all of Revolut’s basic Freelancer features, including five no-fee local transfers.

Professional

For €5 per month, you also get access to a further 20 no-fee local transfers.

Ultimate

For €19 per month, you also get access to 100 no-fee local transfers, 5 no-fee international transfers and one complimentary Metal card.

Company

For large and medium-sized organisations, Revolut’s Company plan offers powerful built-in tools to handle all things finance. Within this plan, there are four price tiers:

Free

For €0 per month, you get access to all of Revolut’s basic Company features, including five no-fee local transfers.

Grow

For €19 per month, you get access to 100 no-fee local transfers, 5 no-fee international transfers and a complimentary Metal card.

Scale

For €79 per month, you get access to 1000 no-fee local transfers, 25 no-fee international transfers, and two complimentary Metal cards.

Enterprise

At a customisable price, you get access to a customisable number of no-fee local transfers, no-fee international transfers, and Metal cards.

Have you ever banked with Revolut Business? Tell us all about your experiences in the comments below!

Revolut Business: Frequently asked questions

Whew, that was quite a lot of information to digest! We totally understand that you may have some lingering questions, so we’ll do our best to answer them below. 👇

Is Revolut Business safe?

With deposits of up to €100,000 per account-holder fully covered by insurance, rest assured that your cash isn’t going anywhere.

Am I eligible for a Revolut Business account?

There are certain requirements to open a Revolut Business account.

These include having a physical presence in an EU/EEA countries, Australia, the United States or the United Kingdom and belonging to a supported industry and supported business type.

Does Revolut Business offer physical cards?

Yes, Revolut offers both physical (plastic and metal) as well as virtual cards.

Can freelancers open a Revolut Business bank account?

Luckily, Revolut Business offers a Freelancer plan specifically for ZZPers in the Netherlands!

The plan also has three price tiers, depending on the scope of your freelance business and the features you want to pay for.

Does Revolut Business offer different currencies?

With a Revolut Business account, you can seamlessly spend as a local in over 25 currencies.

Does Revolut Business have a transfer limit?

There are transfer limits for both local and international transfers, with fees priced at €0.20 and €5 per transaction, respectively. However, depending on your plan, you may receive a number of free transfers.