Your head is probably full of Christmas to-do lists and ambitious New Year’s resolutions, but there is one more important thing to consider before ringing out 2022: your Dutch health insurance.

Can’t you just add “finding (or changing) health insurance” to your 2023 resolutions, you may ask? No. Definitely not. In the Netherlands, you can change health insurance only once a year, and the deadline for doing so is December 31.

However, there’s no need to stress out just yet. It’s common practice in the Netherlands to change your insurance policy last minute. Some Dutchies even wait until New Year’s Eve! Nevertheless, it’s probably a good idea to look at it before the champagne kicks in.

So, here are eight crucial things you should know about Dutch health insurance as an international.

1. Taking out health insurance is mandatory in the Netherlands

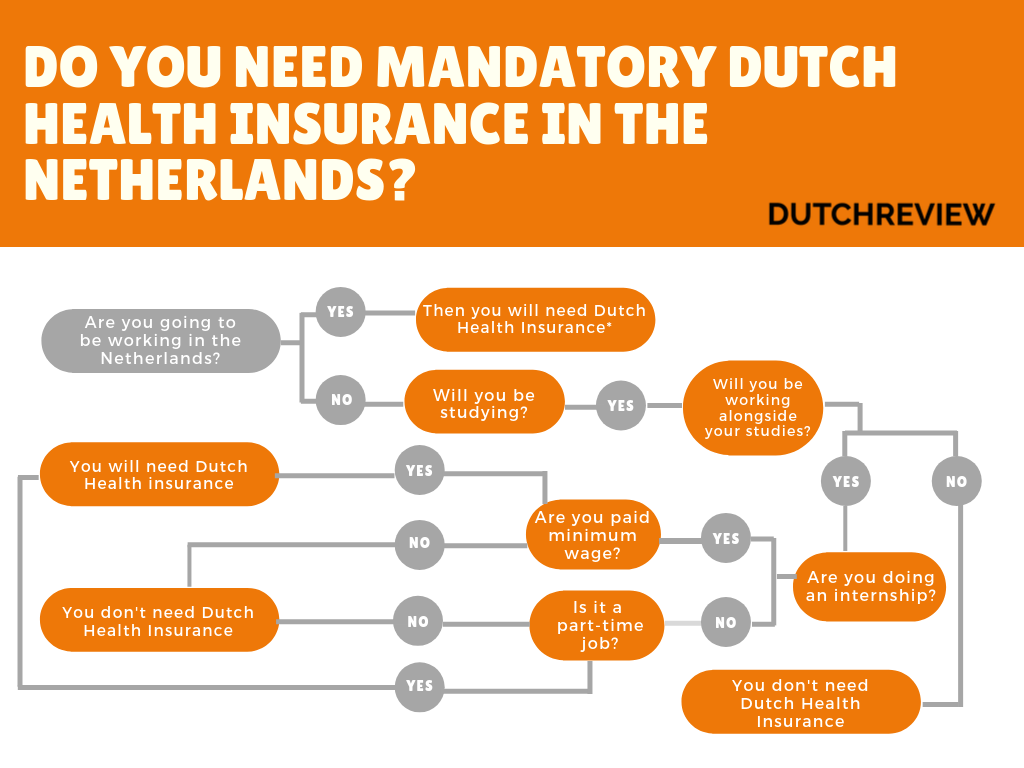

Well, at least it’s as good as mandatory. If you’re wondering whether you need to take out health insurance in the Netherlands, you should ask yourself two things: Are you working? And are you getting paid minimum wage?

If the answers are yes, you should take out Dutch health insurance.

Every person who lives and works in the Netherlands — including internationals — is legally obliged to take out at least a standard health insurance policy.

If you don’t, you’ll receive a letter from the CAK — a public service provider implementing regulations on behalf of government bodies (in this case, the Ministry of Health, Welfare, and Sport). This letter will kindly inform you that if you don’t take out Dutch basic insurance, you’ll be fined €437,25. 🙃

Good to know: If you’re an Erasmus student or an international student and aren’t working in the Netherlands or if you’re staying less than four months, then you won’t have to take out Dutch health insurance.

2. There are four different types of health insurance in the Netherlands

With that lovely little fine in mind, let’s look at some typical health insurance policies, shall we?

To fulfil the insurance obligation, you’ll need to at least take out standard health insurance (basispakket). So let’s begin. Basic health insurance in 2023: what does it mean?

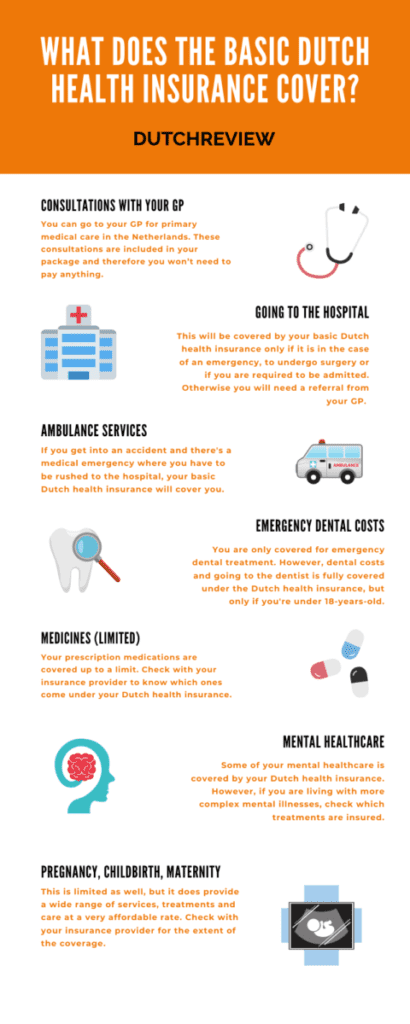

Simple, it’s just a policy that covers, well, the basics: emergency care, ambulance rides, GP visits, and some mental health care. This is not an exhaustive list, but you get the idea — if you’re an overall healthy individual, then a basic package is all you need.

However, each possible Dutch health insurance package, including the basic one, comes in multiple shapes and sizes (four, to be precise). So, when searching for health insurance in the Netherlands, pay attention to whether it’s labelled as:

- a restitution (restitutie),

- combination (combinatie),

- in-kind (natura),

- or budget policy (budget).

Let’s look at an example of why this is important: a restitution policy will give you a lot of flexibility by offering you the choice to see any care provider you fancy. With an in-kind policy, on the other hand, you’ll pay extra if you choose a care provider who doesn’t have a price agreement with your insurer.

That doesn’t necessarily mean that a restitution policy is better than an in-kind policy — merely that you should think about your needs and priorities before selecting your Dutch insurance type. After all, the extra flexibility will also be reflected in your premium.

3. Comparing Dutch health insurance will save you money

Okay, there are four different types of Dutch health insurance. Got it. On top of that, there are about 60 different health insurance providers in the Netherlands — giving you a grand total of about 900 different policies to choose from. 😨

So, to avoid being too overwhelmed by choices, we highly recommend using an online comparison tool to find the perfect health insurance for you.

Normally all you need to do is type in your birthday, your biological sex, the city you live in, whether you’re a student, and if you want to co-insure any family members. A proper comparative website will then offer a good overview of everything you need to know about Dutch health insurance as an international.

There’ll be a few more questions to establish whether you need supplemental insurance, but in a few clicks, you’ll have the top three insurance policies for you. Easy! Then, all you need to do is check out the terms of each, and you’ll be ready to take out your preferred policy directly online.

4. The price of insurance premiums is going up (again)

The money you pay for your health insurance is called a premium (zorgpremie or premie zorgverzekering in Dutch). In the Netherlands, you can pay it either on a monthly basis, or in one lump sum at the beginning of the year (which is cheaper in the long run).

On Budget day (September 20), the Dutch government estimated that each person in the Netherlands would spend about €12 per month more on health insurance in 2023 compared to this year — jammer!

But why do premiums rise every year? There are three reasons for this:

- The aged population is growing, and more care is therefore needed.

- Newer and better treatments and drugs are becoming available, but they are also more expensive.

- Increases in health care sector wages.

5. The Netherlands offers a healthcare allowance

Although Dutch health insurance premiums are becoming more expensive, you don’t have to watch your monthly budget crumble just yet.

The Dutch government offers something called healthcare allowance (zorgtoeslag) which is a financial contribution meant to ensure that you can take out health insurance without breaking the bank. 🙌

Good to know: The Dutch healthcare allowance has been adjusted in accordance with the increase in health insurance premiums.

To be eligible for healthcare allowance, you must:

- Be 18 years of age or older, and have compulsory Dutch healthcare insurance.

- Have a yearly income of less than €38,520 in 2023.

- Have a nationality from an EU country, Liechtenstein, Norway, Iceland or Switzerland.

READ MORE | All you need to know about healthcare allowance in the Netherlands

6. Things are changing in Dutch basic health insurance

Last year, it was established that people who are recovering from coronavirus (or have persistent complaints) would be eligible for additional treatments via their basic health insurance. This year, a whole lot of other things are changing in Dutch health insurance coverage as well.

Let’s start with the good news: the general increase in premium prices means your healthcare allowance (if you’re eligible) will also increase (phew!).

Also, the deductible amount on your health insurance will, thankfully, stay the same. Finally, if you’re expecting a new addition to the family in 2023, you might be interested in hearing that non-invasive prenatal tests (NIPT) will be completely free from April onwards.

On a less positive note, discounts on collective health insurance will be abolished, meaning some of us are in for an even more expensive 2023 than we might have thought.

While some conditions apply, it’s a major bump up for basic health insurance in the Netherlands. 🎉

7. Dental care is not included in your Dutch health insurance

The basispakket (basic Dutch health insurance) only covers dental care up to 18 years of age.

However, chances are you’ve blown out those candles a long time ago (and eaten a lot more cake since), so when looking at your Dutch health insurance for 2023, consider whether you want to add dental care as supplementary insurance (aanvullende verzekering).

This isn’t always necessary but really depends on your personal situation.

8. Dutch health insurance can also cover you abroad

As an international, an important aspect of finding or changing Dutch health insurance is whether you’re covered outside the borders of the Netherlands.

In general, you can rest assured that the basic health insurance includes emergency care abroad. For travelling in Europe, you can count on the trusty European Health Insurance Card (EHIC) to access medical facilities in the EU, without having to cough up money in a pinch. However, the extent of coverage beyond that will depend on your specific insurance policy.

If you’re planning on travelling outside of Europe, you can take out additional health insurance that’ll cover your medical needs no matter where you are in the world.

There you have it, eight must-knows about Dutch health insurance to take you into 2023, safe, secured, and healthcare savvy. 🍾

Do you have any tips for finding or changing Dutch health insurance? Tell us in the comments below!