The 30% ruling in the Netherlands — if you’re an expat here or planning to become one, you’ve probably heard of it. But what does it actually entail?

The 30% ruling, also known as the 30% facility, is a tax advantage specifically designed for highly skilled migrants in the Netherlands.

This ruling can significantly impact your take-home pay, making it a crucial aspect to understand if you’re planning to work in the Netherlands. ⚡️

But how does it work? How do you qualify for it? And how much money does it save you?

Let’s break down everything you need to know about the 30% ruling in the Netherlands in 2025.

Moving to the Netherlands? How exciting! ING, the bank of the Dutch (and the expats!), is your go-to for all things finances — from current accounts to investments and mortgages. Open your account now.

- What is the 30% ruling in the Netherlands?

- How does the 30% ruling work?

- Eligibility for the 30% ruling in the Netherlands

- How long does the 30% ruling in the Netherlands last?

- How to apply for the 30% ruling in the Netherlands

- Benefits of the 30% ruling in the Netherlands

- Changes to the 30% ruling in the Netherlands

- What happens to the 30% ruling if you change jobs?

- The 30% ruling in the Netherlands: Frequently asked questions

What is the 30% ruling in the Netherlands?

Let’s start with the most basic question first: What the frikandel actually is the 30% ruling?

The 30% ruling in the Netherlands is a tax break designed to entice highly skilled migrants to bring their brilliance to the land of windmills and stroopwafels.

If you meet certain conditions (more on that later), your employer can pay you up to 30% of your salary tax-free for five years.

The program’s goal is to bring international talent to the Netherlands and help them out with the extra costs of living and working abroad, like higher rent, language lessons, and the hassle of moving.

READ MORE | How to land a sponsored job in the Netherlands in 2025

It’s a win-win: talented people get the support they need to settle in, and the Netherlands gets to benefit from their skills and experience!

How does the 30% ruling work?

Highly skilled migrants who land a job under the 30% ruling can enjoy a sweet tax break.

However, it’s worth noting that new applicants will not benefit from a 30% tax cut for the whole five years (well, not anymore).

Instead, the 30% ruling will be reduced to 27% as of January 1, 2027.

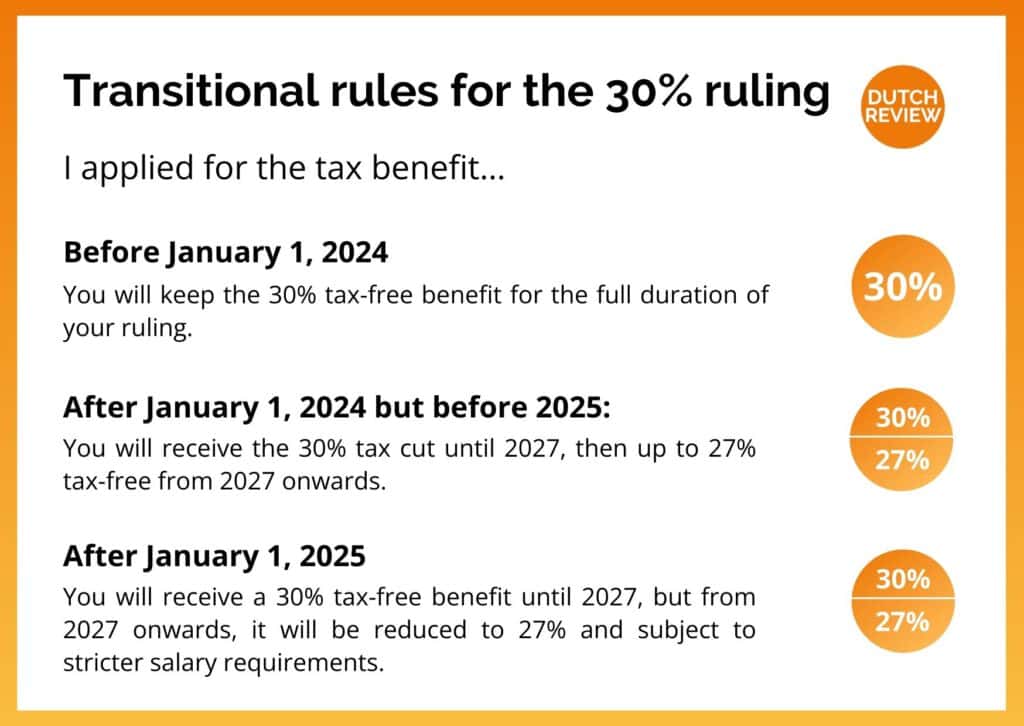

Until then, the following transitional rules apply:

- Employees who had the 30% ruling before January 1, 2024 will keep the 30% tax-free benefit for the full duration of their ruling.

- Those who received the 30% ruling in 2024 will receive the 30% tax cut until 2027, but will only get up to 27% tax-free from 2027 onwards.

- Employees who receive the 30% ruling from 2025 must meet a new, stricter salary criteria to remain eligible beyond 2027.

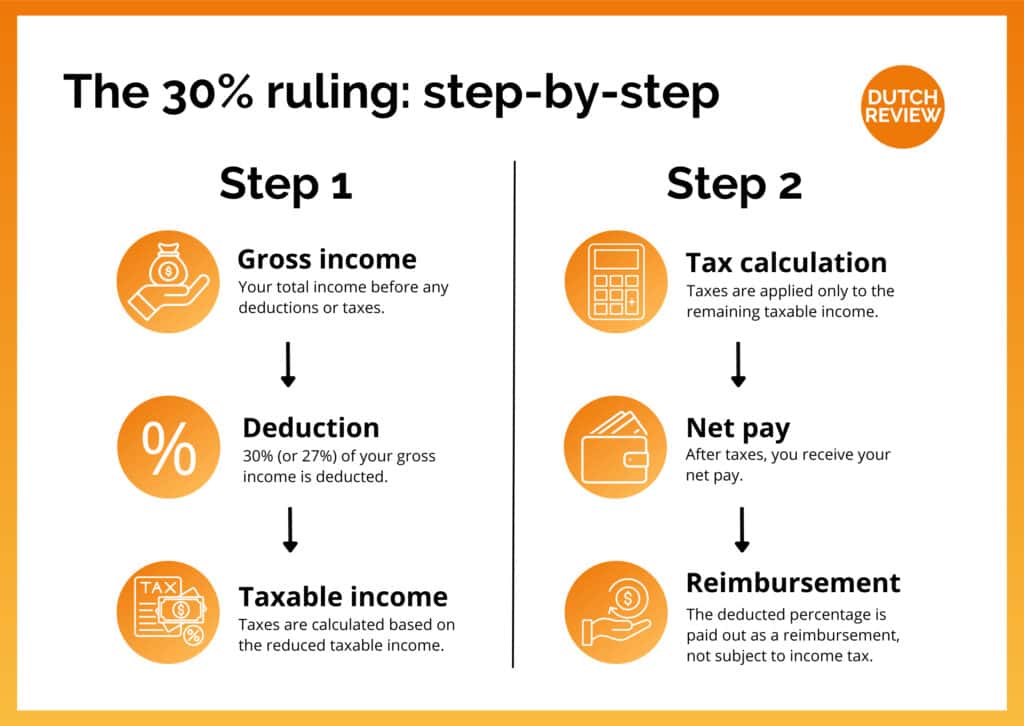

Here’s how it works. Your employer deducts the respective percentage (30% or 27%) from your gross income (i.e. the total amount you earn before deductions and taxes). Taxes are then calculated on the remaining amount, which is your taxable income.

This taxable income must be above the 2025 minimum salary requirement of €46,660 if you’re over 30, and €35,468 if you’re both under 30 and hold a Master’s degree.

These salary minimums apply to everyone except scientific researchers, PhD holders, and doctors training to be specialists.

But there’s not just an income minimum to be eligible for the 30% ruling; there’s also a maximum. More specifically, in 2025, the maximum salary eligible is capped at €246,000 per year.

READ MORE | What is the average salary in the Netherlands? What you need to know in 2025

Once the taxes are sorted, the deducted percentage is added back to your net pay as a reimbursement of expenses, which isn’t subject to income tax.

If your taxable income doesn’t hit the required threshold, you can still benefit from a tax break, just not to its full extent. So, it’s a win either way!

To make this clearer, let’s look at two examples.

Example 1: Mara is 45 years old and earns €100,000 gross per year. Under the 30% ruling, €30,000 of her salary is tax-free, which means her taxable income is €70,000.

Since €70,000 meets the minimum salary requirement for the full 30% ruling, Mara gets the full tax-free allowance of €30,000.

Example 2: Jim is 35 years old and earns €50,000. With the 30% ruling, his taxable income would drop to €35,000, which is below the minimum salary requirement of €46,660. As a result, Jim can only receive a partial tax-free allowance.

To meet the minimum taxable salary requirement, his maximum tax-free amount is limited to €3,340 (€50,000 − €46,660). This means his tax-free allowance equates to 6.68% of his salary (instead of the full 30%).

Eligibility for the 30% ruling in the Netherlands

Okay, we’ve established that the 30% ruling is a tax benefit for highly skilled migrants. But… who is a skilled migrant?

READ MORE | 10 things to know before finding work in the Netherlands as an international

To be eligible for the 30% ruling in the Netherlands, you must:

- Meet the general requirements that apply to everyone:

- Have a valid passport or other travel document,

- Not pose a danger to the public order, and

- Be willing to undergo a tuberculosis (TB) test.

- Have an employment contract with an employer or research institution that is a sponsor recognised by the IND.

- Have expertise or experience that is scarcely available in the Netherlands.

- Meet the income requirements. These change every year on January 1.

- Earn a salary that corresponds to the market rate in your field.

- Have been hired outside the Netherlands. Specifically, you must have lived more than 150 kilometres in a straight line from the Dutch border for more than 16 months in the 24 months before your first working day in the Netherlands.

What counts as “expertise that is scarcely available” in the Netherlands?

Great question. Unfortunately, there are no set guidelines for this requirement. Instead, this scarcity is determined by factors such as salary, employment history, education, and level of employment. The skills are assumed to be present if the minimum salary requirement is met.

Special requirements for recent PhD graduates, researchers and medical specialist trainees

Are you a PhD graduate, researcher, or medical specialist trainee? You’re in luck because the 30% ruling in the Netherlands includes special arrangements for people like you!

READ MORE | Salaries in the Netherlands: the ultimate guide to Dutch wages

These exemptions make qualifying for the tax benefit easier for these professionals.

- Recent PhD graduates don’t need to prove that their expertise is scarce in the Dutch labour market and their minimum salary threshold is lower.

- Researchers working at a research institution also don’t need to demonstrate a scarcity of expertise as long as the institution is recognised by the Dutch government.

- Medical specialist trainees are eligible for the 30% ruling even if their training period extends beyond the usual duration. They also benefit from a lower minimum salary requirement.

Financial rules and regulations for expats in the Netherlands can be complex — so go for a bank that understands. As the biggest bank in the Netherlands, ING knows what expats want and need. Open an account now.

How long does the 30% ruling in the Netherlands last?

Sadly, the 30% ruling is not a forever deal and only applies to your first five years of employment.

Whereas international employees used to be able to get the 30% tax cut for the entirety of the five years, this will be reduced to 27% as of 2027.

READ MORE | The best banks in the Netherlands for internationals in 2025

With the ruling only applying for a five-year duration, it’s crucial to plan your financial future accordingly.

How to apply for the 30% ruling in the Netherlands

Applying for the 30% ruling in the Netherlands involves several steps, but the overall application procedure is pretty straightforward.

Naturally, you’ll first need to secure that sweet Dutch job offer and ensure your employer is willing to cooperate with the 30% ruling.

READ MORE | 13 companies in the Netherlands that hire internationals in 2025

After that, it’s time to submit a joint application with your employer. Along with this, you’ll need to provide several documents, including:

- A valid passport or photo ID

- Your Dutch employment contract or a confirmation letter of your position

- A valid work permit, if applicable

- Your Dutch social security number (Burgerservicenummer)

- Proof of your address in the Netherlands

- Proof of residence in another country before your hiring process started

Once you’ve completed and signed the form, you can send it to the Dutch Tax Office at the following address:

Belastingdienst/Kennis- en Expertisecentrum Buitenland

PO Box 2865

6401 DJ Heerlen

The Netherlands

They will get back to you with their decision within eight weeks.

Benefits of the 30% ruling in the Netherlands

Extra money is pretty sweet, huh? But the 30% ruling in the Netherlands offers more perks than just fatter paychecks. Let’s talk about the other benefits.

First off, the 30% ruling simplifies your tax return process, and some expats may also be exempt from certain Dutch taxes.

READ MORE | Permits and visas for the Netherlands: ultimate 2025 guide

Another bonus is that if you’re eligible for the 30% ruling, you can easily swap your foreign driver’s licence for a Dutch one.

Many non-EU drivers would normally need to retake the driving test, but not with the 30% ruling. Just exchange your licence and you’re all set to cruise! 🚗

Changes to the 30% ruling in the Netherlands

The Dutch 30% ruling was first introduced in 1964 under the Dutch Wage Tax Act. Since then, the Netherlands has attracted international talent from around the globe. Of course, the scheme has undergone many changes over the years.

Until the end of 2018, the 30% ruling in the Netherlands lasted for eight years rather than five, but the Dutch government decided to reduce it to five years starting from January 1, 2019. (😡)

Then, the government decided that the amount of the benefit should also decrease to 27% from 2027.

What happens to the 30% ruling if you change jobs?

Are you thinking about changing jobs? Don’t worry — you don’t necessarily have to kiss the 30% ruling goodbye.

If you switch employers within the Netherlands, you can still keep the ruling, but there might be a few bureaucratic hoops you’ll have to jump through.

If you are changing employers within the same corporate group and still meet the conditions for the 30% ruling with your new job, your 30% ruling will remain valid without submitting a new application. All you have to do is verify with your employer that your new and previous employers are part of the same corporate group.

READ MORE | 7 ways a Dutch job is different

Switching to a new corporation? Then, you’ll need to check with your new employer to see if your 30% ruling can stay valid. Naturally, your new employer must be a registered sponsor with the IND, and your salary must still meet the requirement.

Besides that, you must begin your new job within three months of leaving your previous one.

Most importantly, your new employer needs to file with you for a (renewal) application. The application should be submitted within four months of starting with your new employer.

It’s a bit of paperwork, but totally worth it to keep those tax-free benefits rolling in.

Lekker poffertjes, charming windmills, picturesque canals, and tax breaks… It’s no wonder so many internationals (us included!) want to make the Netherlands their home.

Understanding the 30% ruling can significantly ease the financial transition into expat life and make your adventure in the Netherlands even more exciting.

So, whether you’ve already packed your bags or are just toying with the idea of moving, this tax advantage is just one of the many perks that make the Netherlands such a fantastic place to live!

What do you think about the 30% ruling in the Netherlands? Share your thoughts in the comments.

The 30% ruling in the Netherlands: Frequently asked questions

What’s the maximum duration for the 30% ruling?

As of now, the maximum duration for the 30% ruling is five years, or 60 months.

What are the requirements to apply for the 30% ruling?

To apply for the 30% ruling in the Netherlands, you must fulfil the following criteria:

- You meet the general requirements.

- You have an employment contract with an employer that is a sponsor recognised by the IND.

- You have expertise or experience that is scarcely available in the Netherlands.

- You meet the income requirements. These change every year on 1 January.

- You earn a salary that corresponds to the market rate in your field.

- You have been hired outside the Netherlands.

How do I apply for the 30% ruling in the Netherlands?

You and your employer must jointly apply to the Dutch Tax and Customs Administration. Along with your application, you will need to send personal documents like a valid passport or photo ID, your employment contract or a confirmation letter of your position, and proof of your address in the Netherlands.

Detailed instructions for the application process can be found on the Dutch government’s website.

What is the minimum salary in the Netherlands for the 30% ruling?

The minimum salary requirement is adjusted on the first day of each year. For the most current figures, check out the official guidelines online.

To qualify for the 30% ruling in 2026, your salary (excluding the tax-free allowance) must be over €46,660 if you’re over 30. If you’re under 30 and have a Dutch academic master’s degree or an equivalent from another country, your salary must be at least €35,468.

If you are a scientific researcher at a designated research facility or are a doctor in specialist training, you can benefit from the 30% ruling regardless of your salary.

Does the tax benefit still apply if I get a salary increase?

Yes, as long as your salary meets the minimum salary threshold, the tax benefit applies, even after a salary increase in the future, including any bonuses or allowances granted.