When buying a house in the Netherlands, many expats struggle with one major factor: Dutch. That’s where English-speaking mortgage providers, like Expat Mortgages, come in.

Of course, choosing an expert to help you with your mortgage is a daunting task. You need someone who is knowledgeable, helpful, and will work hard to secure the best deal for you.

They should also be great communicators because they’ll be translating a lot of tricky Dutch concepts into English for you.

As a stronghold in the expat mortgage industry, Expat Mortgages have been playing the game for a long time. In fact, in over 17 years of operation, they’ve helped over 10,000 expats finance their homes in the Netherlands.

But does Expat Mortgages live up to the hype? I put them to the test when purchasing my first home in the Netherlands.

First contact

The first steps are easy: Expat Mortgages’ website allows you to book a free appointment with an advisor.

They also have a Chat window (run by real people, not AI!) where you can immediately ask questions about getting a mortgage in the Netherlands.

The preparatory paperwork

Prior to our meeting, we were given a task: upload some basic documents into our Expat Mortgages Digifile. We were sent a link to the online platform which provided a secure and encrypted area for all of our personal documents.

As a start, we had to upload things like my residence permit, passport copies, payslips, and an inventory form that asked some typical questions about our salaries, lifestyle, and mortgage requirements.

The preparatory paperwork wasn’t too extensive, though — in the end, it took us less than an hour to gather and upload everything.

I did notice that the Digifile is through a Dutch website, so while all the requested documents were written in English, there was some Dutch that I had to navigate through. In saying that, it was easily done, even for people with limited or no Dutch.

READ MORE | 7 questions answered about getting a Dutch mortgage in 2024

With our documents added, we sent the information whizzing through cyberspace to our newly-assigned mortgage advisor, Richardo, and settled in to wait for our next meeting, with questions already beginning to float in our heads.

The initial appointment

The questions spinning in our minds were quickly put at ease when we met Richardo. He travelled to our city of Utrecht for the appointment, grabbed us a coffee, and immediately made us feel comfortable.

What we loved was that it wasn’t straight to business. As Richardo said, “We can talk about mortgages anytime.”

Instead, he first really focused on getting to know us. He asked us questions about how we ended up in the Netherlands, what our backgrounds were, our jobs.

His huge smile and casual manner took away any prior conceptions we had of sitting in a stuffy bankers office — rather, it felt like having coffee with a friend.

READ MORE | Your borrowing power for a mortgage in the Netherlands in 2024

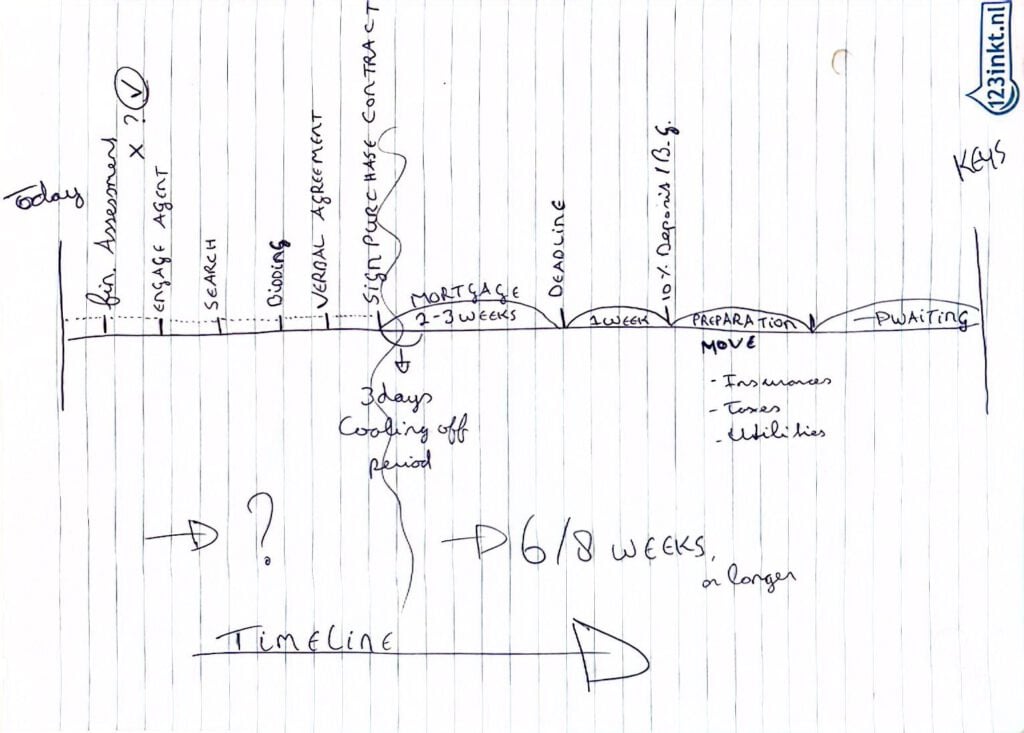

Eventually, we got down to the mortgage stuff. Richardo, armed with the knowledge we had provided in our preparatory paperwork, set out explaining each step of the mortgage process, drawing it on a piece of paper as he went.

He began with a timeline, spanning from our first meeting to getting the keys to a house, effortlessly explaining all the steps that went in between: the preparation, the moment we could stop gazing wistfully at Funda and start seeing houses, when we would need to provide documents, the cooling-off periods, and more.

With the timeline, we could really see when we could be handed the keys to our very own house — a pretty exciting moment.

Richardo then outlined other parts of the process: the costs of getting a mortgage, broken down into each and every part, explaining which parts we could skip and which costs were necessary — plus, which ones were tax deductible.

Finally, Richardo outlined the types of mortgages available in the Netherlands: linear and annuity, explaining the pros and cons.

This introduction to the mortgage process was not only needed, but gave us a great roadmap moving forward.

At the end, Richardo sat back and we blasted him with the questions. From queries on what to do with the house if we moved away to what documents we needed to provide, he hit back clear answers with a Serena Williams-like ease.

READ MORE | Am I eligible to get a mortgage in the Netherlands?

As the three of us left the meeting location, wandered down the stairwell together, and waved goodbye on Utrecht’s Lange Visstraat, my partner and I simultaneously agreed — we knew we were in safe hands.

The searching process

Little did we know, the hard work was really about to begin: the house hunt. We were searching in Utrecht, one of the toughest areas for first-home buyers to break into the market.

How tough? Well, all up, we went to 36 different house viewings. Of those 36, we bid on 10 of them. We only won one (our favourite!).

Richardo had mentioned in our first meeting that during the process, he would go into “Sleep mode,” ready to spring into action once we had a successful bid.

However, he remained in regular contact with us to check in on the house search and answer our various questions that popped up, like:

- Can we bid €XXX,XXX on this house?

- How will the NHG changes impact our mortgage?

- How quickly could we organise a mortgage?

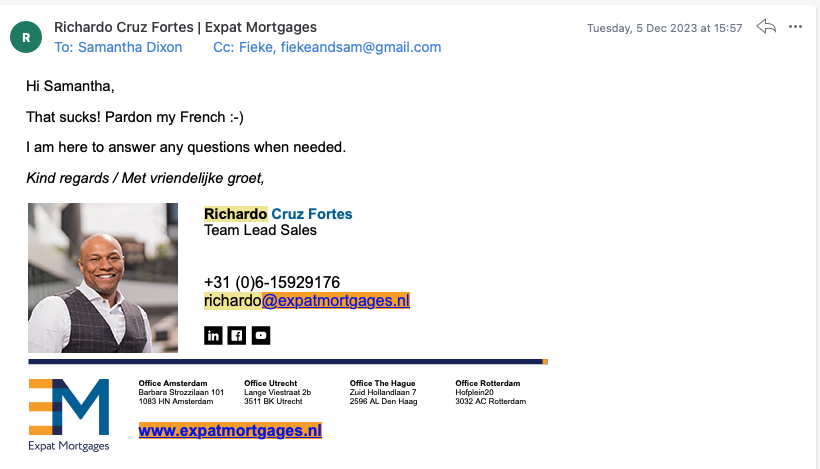

Sometimes, it would take a few days to get an email back, but urgent emails always received a quick response. I really liked that every question was properly responded to, with full information and a friendly tone.

The mortgage process

Finally the big day came: we made an offer, and with a slight renegotiation, it was accepted. Hoera!

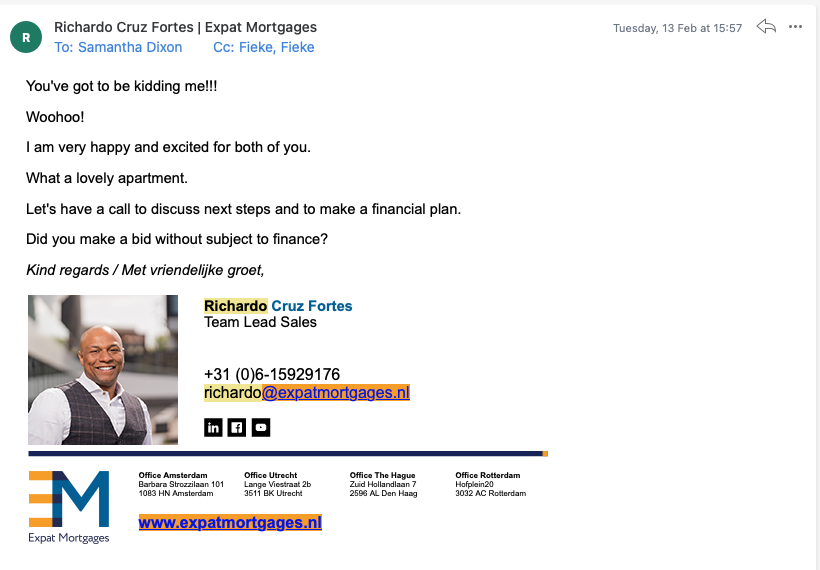

We immediately emailed Richardo with the news, receiving back a resounding “Woohoo!” email reply. Not a typical stuffy response, right? We really enjoyed Richardo’s personality and how he could make us feel comfortable.

READ MORE | What costs do you pay when buying a house in the Netherlands?

From there, Richardo came out of hibernation and kicked into action.

He scheduled a video call for us the next day where he took us through the sales contract, highlighting the most important information, checking that everything was goed and that the sellers hadn’t snuck in any strange terms.

Luckily, Richardo had been proactive in collecting and requesting updated documents during our house hunt.

Less luckily, applying for a mortgage always means a mountain of paperwork, so we started working through our to-do list of proof of savings accounts, client application forms, employment contracts, and our signed purchase contract.

And then…with trepidation, all our documents were handed in, double-checked by Nadine at Expat Mortgages, and sent zooming off to our chosen bank.

READ MORE | 7 Dutch cities to move to right now (recommended by mortgage experts)

From here, we waited anxiously to hear back if our mortgage would be given the go-ahead. Finally, the email came with the glorious subject line: “File approved!”

There were celebrations, champagne, and a feeling of elation hanging in the air — we had bought a house!

The handover

Of course, nothing was official until the final handover date. On a cloudy day, we hopped on our bikes to our notary’s office at Van Grafhorst Notarissen in Utrecht.

There, we had a pleasant surprise: Richardo was waiting for us, along with our real estate agent.

Richardo explained that while mortgage advisors can’t make it to every handover, they try to come when their schedules allow to ensure everything runs smoothly.

READ MORE | Which experts can save you money when buying a house in the Netherlands?

That’s handy, because the notary (notaris in Dutch) is where all the official business goes down. The owners receive the money from our mortgage provider, and we receive the keys from the owners.

With Richardo by our side, we went through the purchase contract, discussed the money, signed the documents — and officially became homeowners in the Netherlands.

Armed with our envelope (containing a surprising number of keys), we left the notary’s office with a mortgage and a home.

The price

Of course, you’re probably wondering: What’s the cost? And can’t I just go to a bank on my own and get a mortgage?

Here’s where I’ll let you in on a little secret: You almost always pay a fee for the advice you receive for your mortgage, even if you’re going direct with a bank.

Expat Mortgages charge €3,150 to handle your entire mortgage process, including ensuring you understand all those tricky Dutch documents. This is approximately on par with other English-language mortgage advisors in the Netherlands.

For transparency: I received a €1,000 discount on my costs at Expat Mortgages in exchange for writing an unbiased review. My partner and I paid the remaining €2,150 personally. My recommendations, thoughts, and opinions in this article are entirely my own and are not influenced by this arrangement.

Final opinion: Is Expat Mortgages worth it?

The big question: Would I recommend Expat Mortgages for expats buying a house in the Netherlands?

Overall, I thought the workflow was fantastic. From the first meeting, it was clear what our next steps were, when Expat Mortgages would be in action, and when they would be stepping back.

Our experience with Richardo was truly ideal: it felt like a friend was arranging our mortgage, and we were never made to feel silly or annoying when asking questions (and we asked a lot).

READ MORE | Is now the time to buy a house in the Netherlands? Here’s what the mortgage experts say

The communication was at times a little bit delayed, but every email and WhatsApp message was always answered with full explanations, which we really appreciated. The English level was top-notch — there was never a point where I felt confused by the tricky Dutch words and concepts.

Finally, while the price is a little bit higher than a standard Dutch mortgage advisor, the difference isn’t immense and it was well worth it to have people specialised in expats on our side.

Overall, we had a seamless experience organising our mortgage and would easily return to Expat Mortgages again.

Cant agree more. I too am a customer of Expat mortgages and my advisor was Roy Bijkerk and all I can say after reading your article is DITTO…DITTO…DITTO. Everything that you experienced in terms of courtesy, friendliness, knowledge of the market and the finality with obtaining the mortgage, was as well experienced by us. 2 things that differ is

No one accompanied us from Expat Mortgages at our notary in Nieuwegein 🙁

One con that till date I experience is the delay in responding to certain emails.

By the way I am on the way to avail their services for a top up mortage for renovating my home