‘Pay with iDEAL’. You sit, staring at your computer screen. Your virtual shopping cart is stacked with goodies ready to be delivered to your door, with one problem: where is the trusty credit card field? What is iDEAL?

And how will you get your silicone tongue to groom your cat with now?! 🐱

It’s a question that has plagued many internationals in the Netherlands. It’s bad enough that many brick-and-mortar stores don’t accept their foreign bank cards, but now the pinnacle of credit card transactions, the internet, is refusing those shiny plastic cards too?

First, a clarification: before the Dutch jump down our throats, we don’t mean specifically ‘credit cards’.

While it’s still up-and-coming in the Netherlands, many overseas countries in the UK, Australia, and the US have debit cards that can be utilised as credit cards, almost specifically so you can shop online without having an actual line of credit.

You may see iDEAL pop up all over the place, sometimes as one option among many, other times as the only option. But what is it, how do you get it, and how do you use it?

Let’s jump right into everything you need to know about iDEAL.

🤨 What is iDEAL?

iDEAL is an online payment system that circumvents the need for the Dutch to have credit cards.

Instead of inputting your card information, paying with iDEAL takes you directly to your personal online banking website where you transfer the money directly to the business owner.

Think of it as a super-fast way to transfer money without needing to gather all the necessary information.

READ MORE | Mastercard to replace Maestro debit cards in the Netherlands in 2023

The iDEAL platform already knows who you want to transfer money to, so as soon as you are logged in it presents you with a confirmation screen — no need to input transaction details. Press confirm, and voila! Your fashionable minion attire is on the way to your door and you couldn’t be happier.

In 2014, a staggering 54 per cent of all Dutch online payments were processed through iDEAL, but not just for goods: you can pay your telephone bill, utilities, car registration, subscriptions, fines, almost anything you would like with the service.

🤷♀️ Why don’t the Dutch just use credit cards?

Let’s start by taking a look at the Dutch word for debt: schuld. Schuld is a word that has a second meaning: guilt. That’s right. Because the Dutch still hold some characteristics from their time as a primarily Calvinist society they believe in only taking what they need.

If you need to go into debt for it, you probably don’t need it (with the exception of homes of course). Lines of credit have just never been a big thing in the Netherlands, so credit cards also never found much of a place.

READ MORE | Dutch Quirk #48: Say no to credit cards

Enter iDEAL. In 2005, ten years after the launch of Amazon and eBay, and just a year after some college kid started up a weird website tracking his fellow students, iDEAL entered the Dutch scene.

It’s been fulfilling the dreams of people who hate dealing with customer service representatives ever since!

🙋♂️ How do I sign up iDEAL?

First, you gotta get with a bank that offers the service. Currently, 12 Dutch banks have iDEAL functionality, so hop on board with one of these ones.

ABN AMRO • ASN Bank • bunq • ING • Knab • Rabobank • RegioBank • Revolut • SNS • Triodos Bank • Van Lanschot • Yoursafe

Currently bankless? Find out all you need to know about setting up a bank account in the Netherlands!

💸 What should I expect when making an iDEAL transaction?

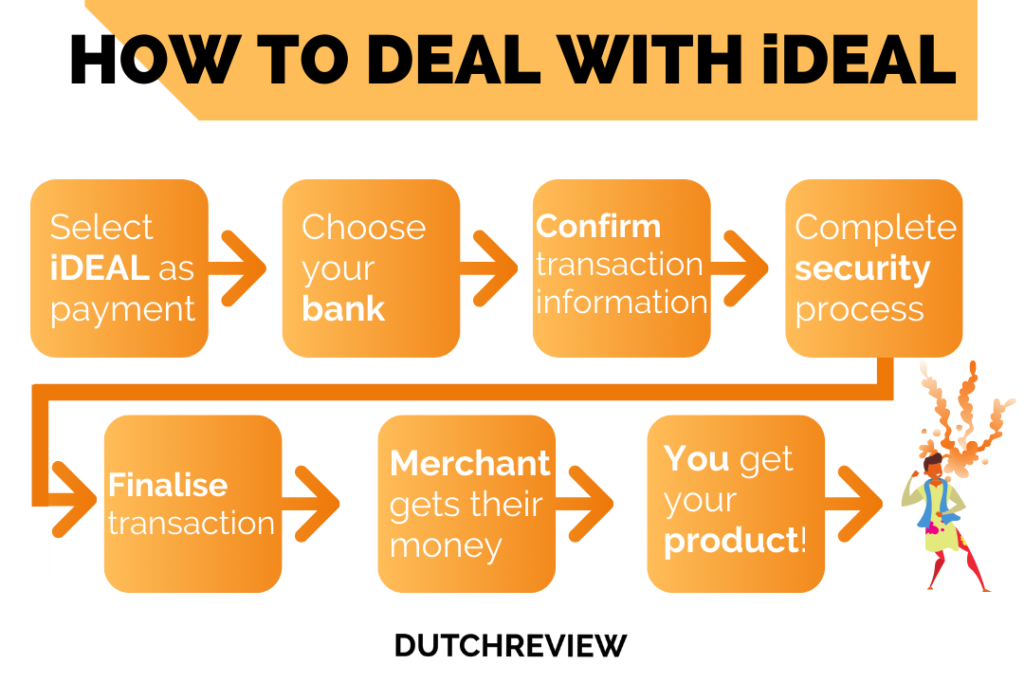

Spending money is scary enough without having to add in a whole other payment system! Luckily, the steps for iDEAL are easy, just a little different to what you’re used to.

1. Select iDEAL

Look for the iDEAL method as a payment option — you’ll recognise the logo!

2. Select your bank

You’ll be presented with a list of banks that participate in iDEAL, just choose yours! The webpage will redirect you to your bank’s login screen (or if you’re on mobile, to the app if you have it installed).

3. Confirm the transaction information

The next thing you’ll see is a confirmation screen. It should have the name of the merchant listed, along with the transaction amount. Select the account you would like the money to be taken from.

4. Complete the security process

Before you get to this step you’ve already passed the first stage of authentication: it may have been your password, a pin code on your app, or even face recognition on your phone.

Now, confirm the transaction by completing the second stage of authentication. What this is will depend on your bank, but it could be your password or pin again, a text message code, or something else.

5. Finalise the transaction

The bank authorises the transaction in real-time and deducts the money directly from your bank account.

6. Merchant receives funds

The merchant will get immediate confirmation that the funds are flying through cyberspace toward their own bank account. This is enough to finalise the transaction.

7. Redirect back to the merchant page

You’ll be redirected back to the merchant page with a confirmation that the payment has been successful and your transaction is complete.

8. [OPTIONAL] Wait impatiently for goodies to arrive at your door

Immediately enter the tracking numbers on the shipping website. Why hasn’t it shipped yet? You completed the order two whole minutes ago!

Your iDEAL questions answered

👀 Is iDEAL secure?

The main security advantage of iDEAL is that you’re not sending your credit card or banking information to random websites. Because it opens through the iDEAL platform, businesses only know if you’ve paid or not: they don’t receive any of your sensitive information.

iDEAL also uses two-factor authentication, as well as any of your own bank’s security features.

❌ Is there any disadvantage to using iDEAL?

As far as we know, just one — but it’s something to definitely keep in mind. When using iDEAL you don’t have the right to initiate a chargeback if something goes wrong with the transaction.

🤔 What is a chargeback, and should it be a dealbreaker?

A chargeback is when a transaction is forcibly reversed by your bank. For example, say you purchased an item online with your credit card. The seller sends you the item, but it’s counterfeit, broken, or never arrives.

The merchant refuses to refund you, so you call your bank and initiate a chargeback.

If the bank deems that you, as the consumer, were wronged they will forcibly take the money from the merchant’s bank account and return it to your own.

It’s a way of getting a refund via the bank, instead of directly via the merchant, and acts as a way of keeping merchants honest and protecting the consumer.

However, when paying with iDEAL you no longer have this option. You don’t have a way to initiate a chargeback through iDEAL, so if something goes wrong you could be the one paying for it.

But let’s be honest: most of us haven’t ever had to initiate a chargeback on our credit cards before. As long as you’re purchasing from trusted websites or businesses there isn’t too much need for concern.

🧐 What the hell is a Tikkie and what’s it got to do with iDeal?

Whew, that’s a whole other bag of worms! Tikkie is an app, and a way of requesting or sending money online. It’s mostly used by friends splitting the costs of bills, but also by businesses.

READ MORE | Dutch Quirk #7: Send a Tikkie for virtually nothing

However, Tikkie is only used for requesting or sending money — the actual transaction is processed via iDEAL. What a friendship!

Have you used iDEAL? Let us know in the comments below! Got any questions about using iDEAL? Leave them there too!

Feature Image: Designecologist/Pexels & iDEAL/Wikimedia Commons

Editor’s Note: This article was originally published in December 2019 and was fully updated in May 2023 for your reading pleasure.

Does anyone know if iDeal works with ING Direct, the Australian version of ING? My daughter is in Europe and apparently some businesses (TUI specifically) don’t accept non European credit and debit cards. Wondering if iDeal is a way around this.

IDeal is short for Internet Deal and specifically for online shopping. It doesn’t work in brick and mortar stored and you need a Dutch bank account. Her best bet is to contact both the Dutch and the Australian branch of IGN and see if either of them can help out.

Revolut also has the iDEAL feature nowadays, might be a good option as it’s free to use

Wrong. It does work in Brick and Mortar stores and is the preferred methiod of getting paid in most Dutch stores

Making payments in the Netherlands can be a real pain in the derriere for foreigners, and this IDEAL system is the latest pain. I’m increasingly finding I can’t make even simple online payments for thins like a telephone SIM card without a Dutch bank account, which I don’t need or want (those banks have zero customer service, have a lot of conditions for opening accounts, and change extra fees for foreigners).

Why the heck don’t they just accept credit/debit card, PayPal, etc. like everybody else in the world? It’s not because of Calvinist guilt – that’s baloney . But what is it?

Dutch banks have shit customer service, weird conditions and hurdles to cross, and from experience many of their clerks are unpleasant towards foreigners, but what surprised me the most is that the frugal Dutch are fine with paying banks a monthly fee for the privilege of letting them hold your money (which they in turn use to make even more money through loans, investments, etc). I guess Dutch banks must be shit at what they do if those activities don’t pay off the costs of having an account.

In my eastern european country, banks stopped charging nonsense fees a decade ago.

Same experience here too. That “guilt” angle is a nice “did you know” handle if you write an article, but having been here for some months now, it just is that they want to suck everything dry to the max. They just want their local (I repeat, local) payment options because the other requires them to pay fees. With they, as typically Dutch, do not want. Because they are not there to serve the customer, but just to piss them off. As you notice, same experience with customer service here. Fun fact: really universal? No fees? Try to pay with cash. Prepare to be labelled a criminal. And prepare to sleep outside…

Even in eastern europe we don’t need something like IDEAL to pay online using our debit cards. I was surprised at first that the frugal Dutch would ever want to use a system like IDEAL, where you even have to pay for the transaction itself, but it seems like Dutch banking services stagnated around Y2K – especially since everyone goes wide-eyed and blurts out a “We don’t use credit cards!” anytime they see a Visa DEBIT or Mastercard DEBIT card.

This article is broadly in favour of IDEAL. I do not see why. For all its so-called advantages the drawback to IDEAL, the inability to make a chargeback, ought to be a deal breaker deal breaker. I would have thought the frugal and risk averse Dutch wold see it as such. Unfortunately, in the Netherlands, IDEAL is the only payment option available at many places.

It may not matter much for relatively small purchases, maybe up to a few hundred Euros, but if I am spending thousands I want my bank to be able to claw back the payment if the goods are not delivered. I do not want the hassle of having to contact the vendor and be given the run-around as I try to get my money back.

Case in point. My wife recently booked) (r to be precise, she tried to book) a flight with KLM and paid with IDEA., but the eticket never arrived. When we contacted KLM we were told that a technical problem was preventing its issue. We wanted to change our booking but a “support” person created a refund request instead. That immediately caused us a problem as we had to get a flight. Fortunately we were able to use a credit card to book with a differnet airline. Now by European reglations a refund ought to be made within seven days. It is now two weeks and counting and we have not had our payment returned. But it ought not even to be processed as a refund, because according to Ducth law KLM is in breach of contract, for taking our money, but failing to fufil their part of the bargain.

If we had paid with just about any method other then IDEAL we’d have asked the bank or Credit Card company to get our cash back and there would have been no problem

Then there is the problem that IDEAL is acceped only in the Netherlands and (I think) Belgium. I cannot buy on-line with it from any other country. I believe our IDEAL only cards are due to be replaced with Mastercards that will function as regular DEBIT cards and allow foreign purchases. I hope so. It is about time.

I hate iDEAL, as far as I can work out, your on your own if you use iDEAL for a purchase. Feeling so exposed is a new experience for me and I don’t like it.

It is also totally useless for dealing with international service providers, as you can’t use it for subscriptions. No it doesn’t do subscriptions with any service I use. Frankly its useless unless you want to scrape ice off you window.

I’m also used to the legal protection of a credit card in the UK for online payments (I used to use mine as a debit card with extra protection, as I grew up not borrowing money). No such protections with iDEAL🤦♂️ My Dutch bank actually warned me not to keep money in my account that connects to iDEAL, as if its taken via iDEAL, you’ve lost it for ever 😕. They stated they had many customers that had been cleaned out this way.

Maybe it’s the “devil you know” scenario, but colour me unimpressed after 8 years of being stuck with it. It would have been so much simpler if people had just worked out you don’t need to use a credit card for credit, and not been triggered by the word credit, into creating the iDEAL ice scraper.

OK so I’ve had a bit of fun playing devil’s advocate with this. But for me, it has been the most useless piece of plastic going. Long live Nederlands